Question: What's the answer please? Please do not use any sort of AI as they provide wrong/different answers! Thank you Firm A is analyzing the possible

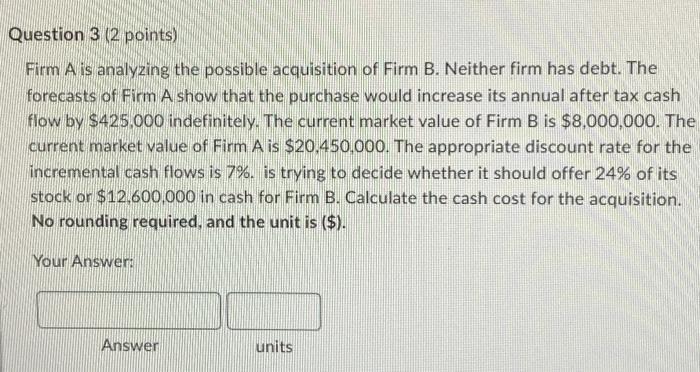

Firm A is analyzing the possible acquisition of Firm B. Neither firm has debt. The forecasts of Firm A show that the purchase would increase its annual after tax cash flow by $425,000 indefinitely. The current market value of Firm B is $8,000,000. The current market value of Firm A is $20,450,000. The appropriate discount rate for the incremental cash flows is 7%. is trying to decide whether it should offer 24% of its stock or $12,600,000 in cash for Firm B. Calculate the cash cost for the acquisition. No rounding required, and the unit is (\$). Your Answer: Answer units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts