Question: When a $ 1 0 0 0 bond is initially sold at 5 percent coupon yield for 3 0 years, $ 5 0 ( .

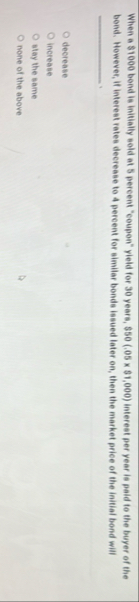

When a $ bond is initially sold at percent "coupon" yield for years, $$ interest per year is paid to the buyer of the bend. However, if interent rates decrease to percent for similar bonds issued later on then the market price of the initial bond will

decrease

increase

slay the same

none of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock