Question: When a company conducts a stock split, it exchanges new shares for old ones according to some ratio. For example, in March 2018, Herbalife conducted

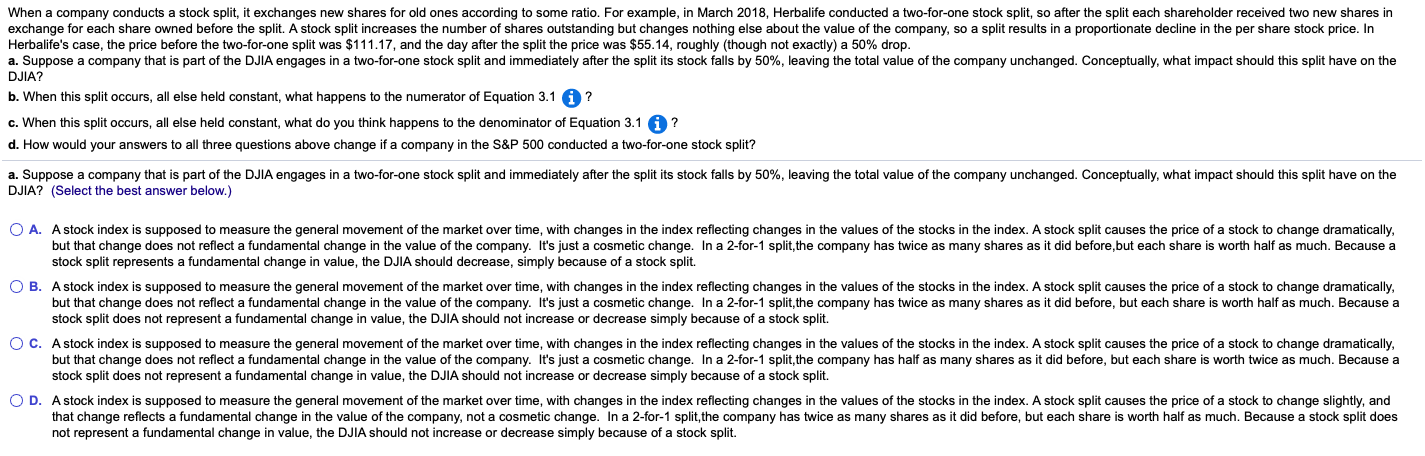

When a company conducts a stock split, it exchanges new shares for old ones according to some ratio. For example, in March 2018, Herbalife conducted a two-for-one stock split, so after the split each shareholder received two new shares in exchange for each share owned before the split. A stock split increases the number of shares outstanding but changes nothing else about the value of the company, so a split results in a proportionate decline in the per share stock price. In Herbalife's case, the price before the two-for-one split was $111.17, and the day after the split the price was $55.14, roughly (though not exactly) a 50% drop. a. Suppose a company that is part of the DJIA engages in a two-for-one stock split and immediately after the split its stock falls by 50%, leaving the total value of the company unchanged. Conceptually, what impact should this split have on the DJIA? b. When this split occurs, all else held constant, what happens to the numerator of Equation 3.1 ? c. When this split occurs, all else held constant, what do you think happens to the denominator of Equation 3.1 A ? d. How would your answers to all three questions above change if a company in the S&P 500 conducted a two-for-one stock split? a. Suppose a company that is part of the DJIA engages in a two-for-one stock split and immediately after the split its stock falls by 50%, leaving the total value of the company unchanged. Conceptually, what impact should this split have on the DJIA? (Select the best answer below.) O A. A stock index i supposed to measure the general movement of the market over time, with changes in the index reflecting changes in the values of the stocks in the index. A stock split causes the price of a stock to change dramatically, but that change does not reflect a fundamental change in the value of the company. It's just a cosmetic change. In a 2-for-1 split, the company has twice as many shares as it did before, but each share is worth half as much. Because a stock split represents a fundamental change in value, the DJIA should decrease, simply because of a stock split. OB. A stock index is supposed to measure the general movement of the market over time, with changes in the index reflecting changes in the values of the stocks in the index. A stock split causes the price of a stock to change dramatically, but that change does not reflect a fundamental change in the value of the company. It's just a cosmetic change. In a 2-for-1 split, the company has twice as many shares as it did before, but each share is worth half as much. Because a stock split does not represent a fundamental change in value, the DJIA should not increase or decrease simply because of a stock split. OC. A stock index is supposed to measure the general movement of the market over time, with changes in the index reflecting changes in the values of the stocks in the index. A stock split causes the price of a stock to change dramatically, but that change does not reflect a fundamental change in the value of the company. It's just a cosmetic change. In a 2-for-1 split, the company has half as many shares as it did before, but each share is worth twice as much. Because a stock split does not represent a fundamental change in value, the DJIA should not increase or decrease simply because of a stock split. OD. A stock index is supposed to measure the general movement of the market over time, with changes in the index reflecting changes in the values of the stocks in the index. A stock split causes the price of a stock to change slightly, and that change reflects a fundamental change in the value of the company, not a cosmetic change. In a 2-for-1 split, the company has twice as many shares as it did before, but each share is worth half as much. Because a stock split does not represent a fundamental change in value, the DJIA should not increase or decrease simply because of a stock split. When a company conducts a stock split, it exchanges new shares for old ones according to some ratio. For example, in March 2018, Herbalife conducted a two-for-one stock split, so after the split each shareholder received two new shares in exchange for each share owned before the split. A stock split increases the number of shares outstanding but changes nothing else about the value of the company, so a split results in a proportionate decline in the per share stock price. In Herbalife's case, the price before the two-for-one split was $111.17, and the day after the split the price was $55.14, roughly (though not exactly) a 50% drop. a. Suppose a company that is part of the DJIA engages in a two-for-one stock split and immediately after the split its stock falls by 50%, leaving the total value of the company unchanged. Conceptually, what impact should this split have on the DJIA? b. When this split occurs, all else held constant, what happens to the numerator of Equation 3.1 ? c. When this split occurs, all else held constant, what do you think happens to the denominator of Equation 3.1 A ? d. How would your answers to all three questions above change if a company in the S&P 500 conducted a two-for-one stock split? a. Suppose a company that is part of the DJIA engages in a two-for-one stock split and immediately after the split its stock falls by 50%, leaving the total value of the company unchanged. Conceptually, what impact should this split have on the DJIA? (Select the best answer below.) O A. A stock index i supposed to measure the general movement of the market over time, with changes in the index reflecting changes in the values of the stocks in the index. A stock split causes the price of a stock to change dramatically, but that change does not reflect a fundamental change in the value of the company. It's just a cosmetic change. In a 2-for-1 split, the company has twice as many shares as it did before, but each share is worth half as much. Because a stock split represents a fundamental change in value, the DJIA should decrease, simply because of a stock split. OB. A stock index is supposed to measure the general movement of the market over time, with changes in the index reflecting changes in the values of the stocks in the index. A stock split causes the price of a stock to change dramatically, but that change does not reflect a fundamental change in the value of the company. It's just a cosmetic change. In a 2-for-1 split, the company has twice as many shares as it did before, but each share is worth half as much. Because a stock split does not represent a fundamental change in value, the DJIA should not increase or decrease simply because of a stock split. OC. A stock index is supposed to measure the general movement of the market over time, with changes in the index reflecting changes in the values of the stocks in the index. A stock split causes the price of a stock to change dramatically, but that change does not reflect a fundamental change in the value of the company. It's just a cosmetic change. In a 2-for-1 split, the company has half as many shares as it did before, but each share is worth twice as much. Because a stock split does not represent a fundamental change in value, the DJIA should not increase or decrease simply because of a stock split. OD. A stock index is supposed to measure the general movement of the market over time, with changes in the index reflecting changes in the values of the stocks in the index. A stock split causes the price of a stock to change slightly, and that change reflects a fundamental change in the value of the company, not a cosmetic change. In a 2-for-1 split, the company has twice as many shares as it did before, but each share is worth half as much. Because a stock split does not represent a fundamental change in value, the DJIA should not increase or decrease simply because of a stock split

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts