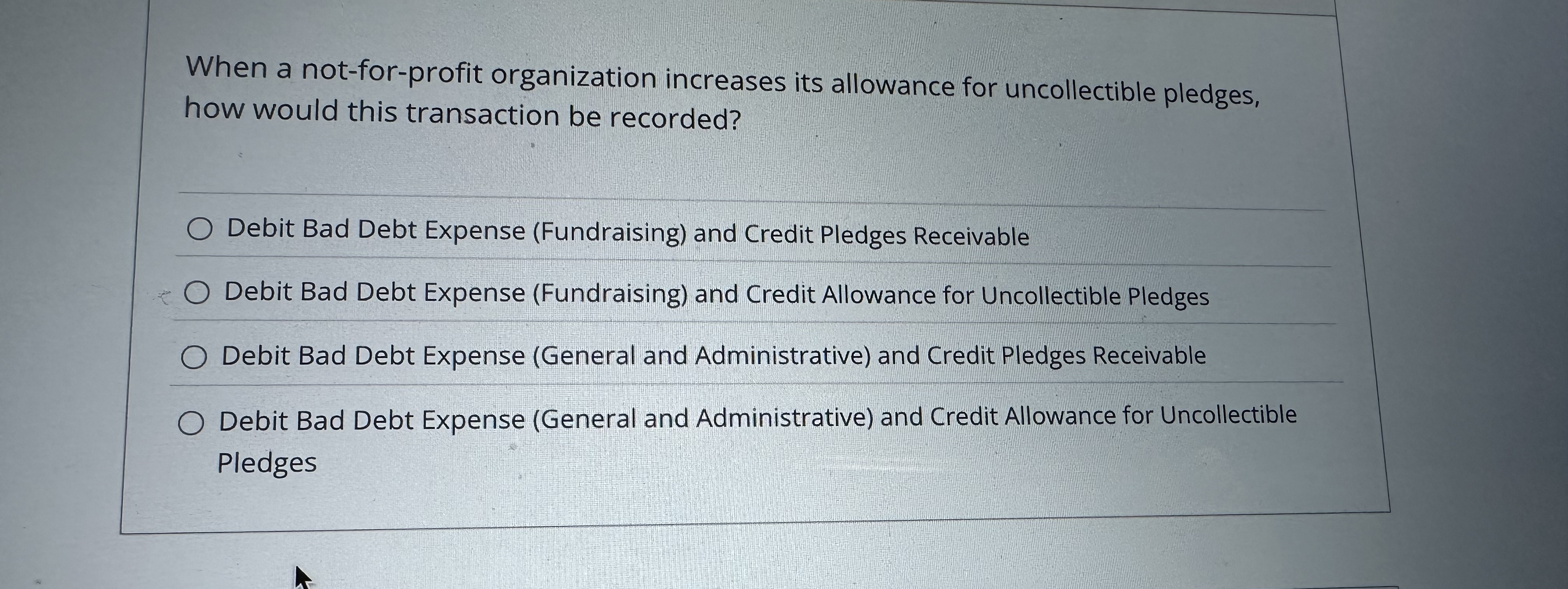

Question: When a not - for - profit organization increases its allowance for uncollectible pledges, how would this transaction be recorded? Debit Bad Debt Expense (

When a notforprofit organization increases its allowance for uncollectible pledges,

how would this transaction be recorded?

Debit Bad Debt Expense Fundraising and Credit Pledges Receivable

Debit Bad Debt Expense Fundraising and Credit Allowance for Uncollectible Pledges

Debit Bad Debt Expense General and Administrative and Credit Pledges Receivable

Debit Bad Debt Expense General and Administrative and Credit Allowance for Uncollectible

Pledges

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock