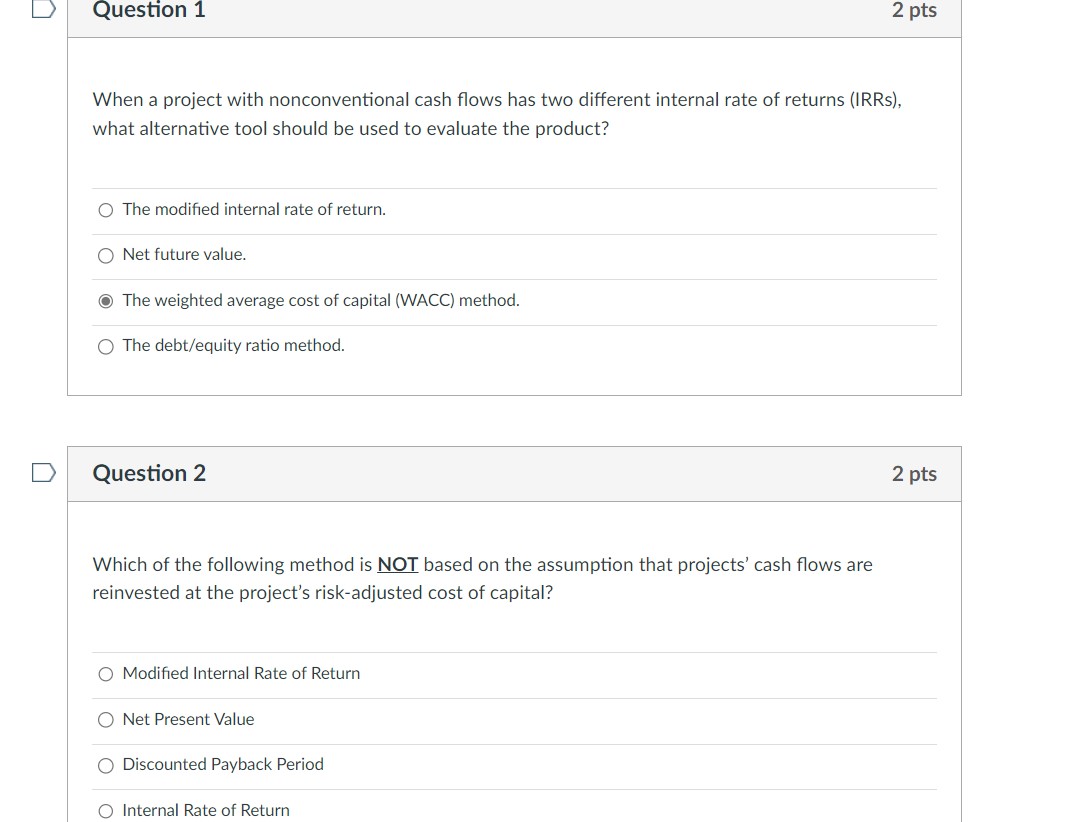

Question: When a project with nonconventional cash flows has two different internal rate of returns (IRRs), what alternative tool should be used to evaluate the product?

When a project with nonconventional cash flows has two different internal rate of returns (IRRs), what alternative tool should be used to evaluate the product? The modified internal rate of return. Net future value. The weighted average cost of capital (WACC) method. The debt/equity ratio method. Question 2 2 pts Which of the following method is NOT based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital? Modified Internal Rate of Return Net Present Value Discounted Payback Period Internal Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts