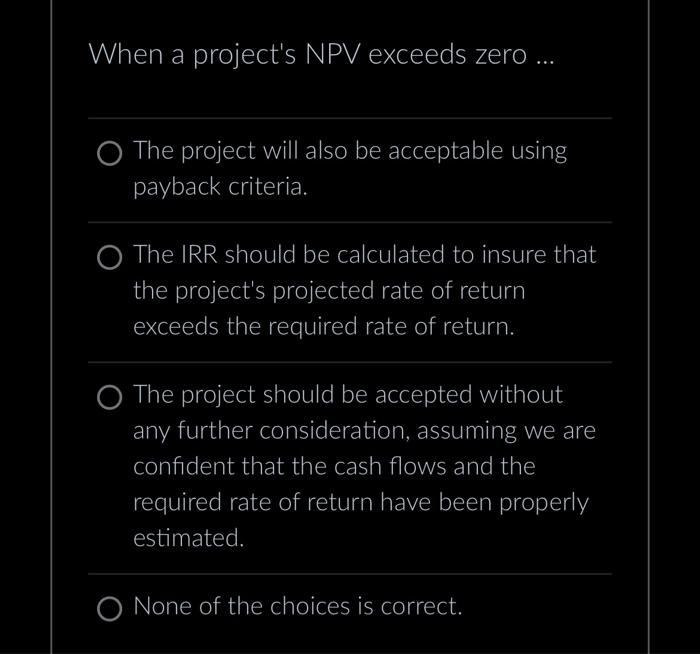

Question: When a project's NPV exceeds zero ... The project will also be acceptable using payback criteria. The IRR should be calculated to insure that the

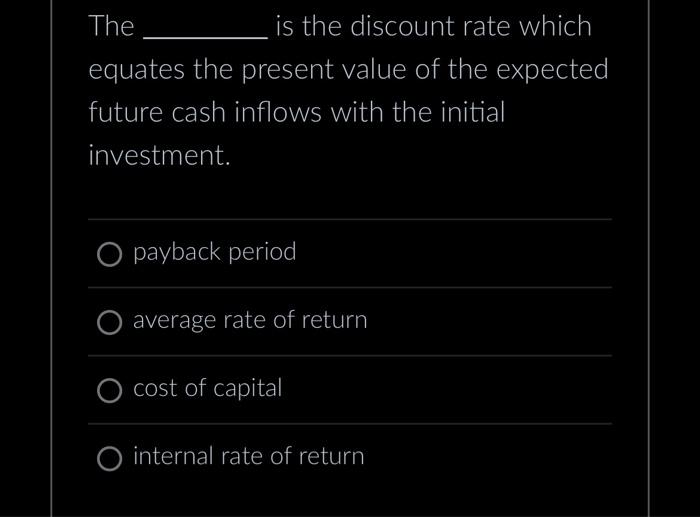

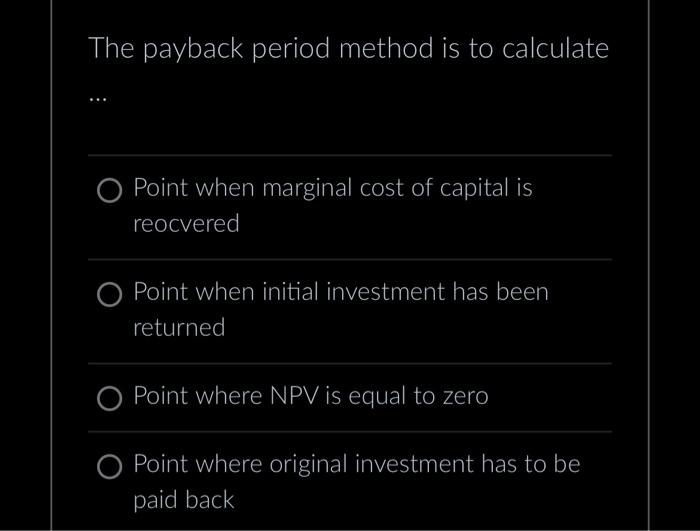

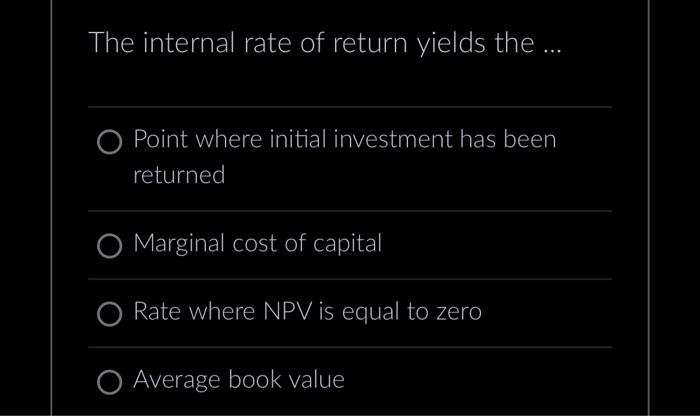

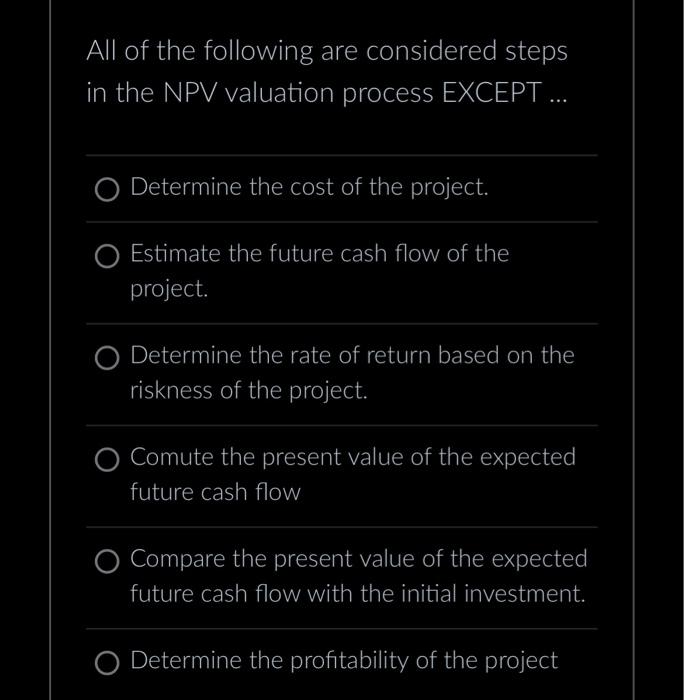

When a project's NPV exceeds zero ... The project will also be acceptable using payback criteria. The IRR should be calculated to insure that the project's projected rate of return exceeds the required rate of return. The project should be accepted without any further consideration, assuming we are confident that the cash flows and the required rate of return have been properly estimated. None of the choices is correct. The is the discount rate which equates the present value of the expected future cash inflows with the initial investment. payback period average rate of return cost of capital internal rate of return The payback period method is to calculate Point when marginal cost of capital is reocvered Point when initial investment has been returned Point where NPV is equal to zero Point where original investment has to be paid back The internal rate of return yields the ... Point where initial investment has been returned Marginal cost of capital Rate where NPV is equal to zero Average book value II of the following are considered steps the NPV valuation process EXCEPT ... Determine the cost of the project. Estimate the future cash flow of the project. Determine the rate of return based on the riskness of the project. Comute the present value of the expected future cash flow Compare the present value of the expected future cash flow with the initial investment. Determine the profitability of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts