Question: When analyzing a particular stock's performance (y) compared to the performance of a related benchmark segment of the stock market (x), the slope is a

When analyzing a particular stock's performance (y) compared to the performance of a related benchmark segment of the stock market (x), the slope is a relative risk measurement. The slope depicts a fund's volatility against the benchmark. Many financial analysts calculate the slopes for stock funds using the S&P 500 Index as the benchmark.

This market model assumes that the rate of return of a stock (y) is linearly related to the rate of return (x) of the benchmark:

y = b0 + b1x.

In this context the slope b1 is usually referred to as the beta coefficient of the stock. Beta is explained at most business-oriented web sites, see for example Morningstar.

- Interpretation of beta

- b1 = 1 means the stock's rate of return moves up and down in perfect harmony with the benchmark market.

- b1 > 1 means the stock's rate of return is more sensitive to changes in the level of the benchmark market than is the average stock.

- 0 b1

Investors with a high tolerance for risk like b1 > 1; they can earn more if the overall market improves slightly, but lose more if the market declines even a small amount. Investors with a low tolerance for risk like 0b1

For example, Texaco has a beta coefficient of 0.44, which means that when the overall market rate of return changes by 1%, Texaco's rate of return changes only 0.44%. So Texaco doesn't move much at all relative to the overall market. An investor with a low tolerance for risk would be attracted to Texaco because its beta coefficient is less than 1.

What does r2 mean?

In this setting r2 measures the proportion of the total risk in the particular stock related to the benchmark market and 1 - r2 measures the proportion of the total risk that is related to specific company-related events and decisions.

DO THE FOLLOWING:

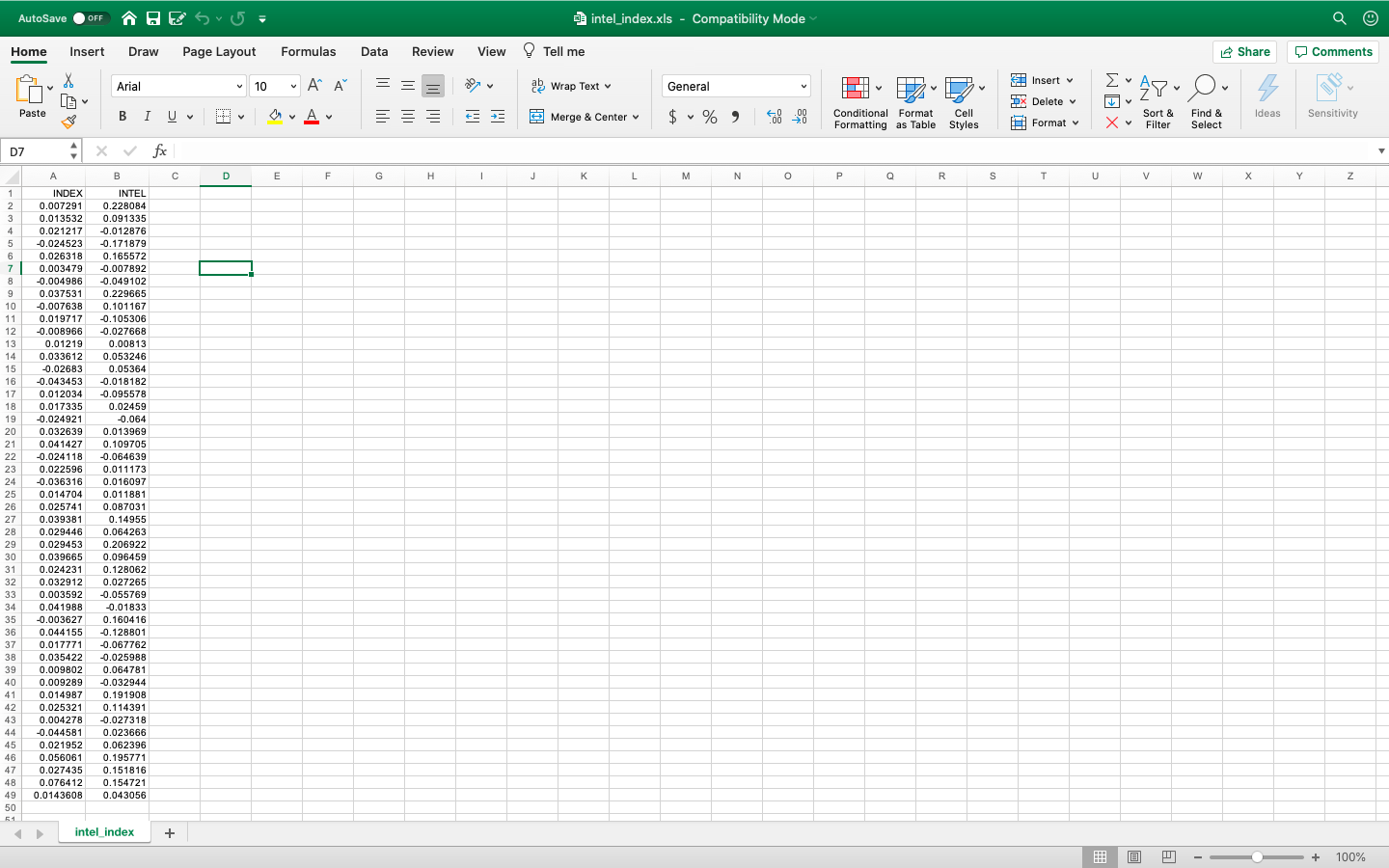

Apply the market model to the Standard and Poor's Composite Index (the x-variable) and the monthly returns of Intel (the y-variable) for a recent 4-year period, which are stored in columns 1 and 2, respectively, in this Excel file

Question 2. What is the value of the test statistic for the hypothesis test H0: b1 = 0, Ha: b1 0?

(use 2 decimal places)

Question 3. What is the P-value for the hypothesis test H0: b1 = 0, Ha: b1 0?

(use exactly 4 decimal places)

Question 4. Calculate a 98% confidence interval for the slope b1.

lower bound (use 3 decimal places) upper bound (use 3 decimal places)

AutoSave OFF HEG5 = intel_index.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share O Comments X Arial Insert v . Ai v = = 10 ab Wrap Text General Do 49- o WEX s DX Delete Paste B I U Av $ % ) Merge & Center .00 00 0 Ideas Conditional Format Cell Formatting as Table Styles Sort & Filter Format Find & Select Sensitivity D7 fx B D E F H 1 J K L M N o Q R S T U w X Y z 1 2 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 A INDEX 0.007291 0.013532 0.021217 -0.024523 0.026318 0.003479 -0.004986 0.037531 -0.007638 0.019717 -0.008966 0.01219 0.033612 -0.02683 -0.043453 0.012034 0.017335 -0.024921 0.032639 0.041427 -0.024118 0.022596 -0.036316 0.014704 0.025741 0.039381 0.029446 0.029453 0.039665 0.024231 0.032912 0.003592 0.041988 -0.003627 0.044155 0.017771 0.035422 0.009802 0.009289 0.014987 0.025321 0.004278 -0.044581 0.021952 0.056061 0.027435 0.076412 0.0143608 INTEL 0.228084 0.091335 -0.012876 -0.171879 0.165572 -0.007892 -0.049102 0.229665 0.101167 -0.105306 -0.027668 0.00813 0.053246 0.05364 -0.018182 -0.095578 0.02459 -0.064 0.013969 0.109705 -0.064639 0.011173 0.016097 0.011881 0.087031 0.14955 0.064263 0.206922 0.096459 0.128062 0.027265 -0.055769 -0.01833 0.160416 -0.128801 -0.067762 -0.025988 0.064781 -0.032944 0.191908 0.114391 -0.027318 0.023666 0.062396 0.195771 0.151816 0.154721 0.043056 intel_index + A + 100% AutoSave OFF HEG5 = intel_index.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share O Comments X Arial Insert v . Ai v = = 10 ab Wrap Text General Do 49- o WEX s DX Delete Paste B I U Av $ % ) Merge & Center .00 00 0 Ideas Conditional Format Cell Formatting as Table Styles Sort & Filter Format Find & Select Sensitivity D7 fx B D E F H 1 J K L M N o Q R S T U w X Y z 1 2 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 A INDEX 0.007291 0.013532 0.021217 -0.024523 0.026318 0.003479 -0.004986 0.037531 -0.007638 0.019717 -0.008966 0.01219 0.033612 -0.02683 -0.043453 0.012034 0.017335 -0.024921 0.032639 0.041427 -0.024118 0.022596 -0.036316 0.014704 0.025741 0.039381 0.029446 0.029453 0.039665 0.024231 0.032912 0.003592 0.041988 -0.003627 0.044155 0.017771 0.035422 0.009802 0.009289 0.014987 0.025321 0.004278 -0.044581 0.021952 0.056061 0.027435 0.076412 0.0143608 INTEL 0.228084 0.091335 -0.012876 -0.171879 0.165572 -0.007892 -0.049102 0.229665 0.101167 -0.105306 -0.027668 0.00813 0.053246 0.05364 -0.018182 -0.095578 0.02459 -0.064 0.013969 0.109705 -0.064639 0.011173 0.016097 0.011881 0.087031 0.14955 0.064263 0.206922 0.096459 0.128062 0.027265 -0.055769 -0.01833 0.160416 -0.128801 -0.067762 -0.025988 0.064781 -0.032944 0.191908 0.114391 -0.027318 0.023666 0.062396 0.195771 0.151816 0.154721 0.043056 intel_index + A + 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts