Question: when answering part 3 please give me the answer for 2021,2022,23,24,25 Duluth Ranch, Incorporated purchased a machine on January 1, 2021. The cost of the

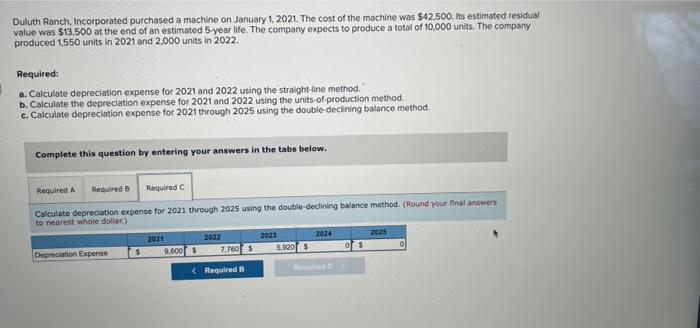

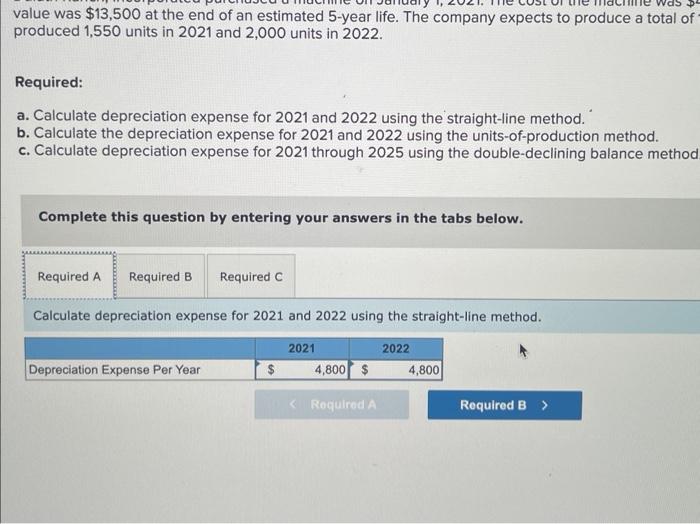

Duluth Ranch, Incorporated purchased a machine on January 1, 2021. The cost of the machine was 542,500 . its estimated residual value was $13.500 at the end of an estimated 5-year life. The company expects to produce a total of 10,000 units. The company produced 1,550 units in 2021 and 2.000 units in 2022 . Required: a. Calculate depreciation expense for 2021 and 2022 using the straight-line method. b. Calculate the depreciation expense for 2021 and 2022 using the units-of-production method. c. Calculate depreciation expense for 2021 through 2025 using the double-declining balance method. Complete this question by entering your answers in the tabs below. Calculate depreclation expense for 2021 through 2025 using the double-declining balance method. (Round your final answers to pearest whole dollar, value was $13,500 at the end of an estimated 5 -year life. The company expects to produce a total of produced 1,550 units in 2021 and 2,000 units in 2022. Required: a. Calculate depreciation expense for 2021 and 2022 using the straight-line method. " b. Calculate the depreciation expense for 2021 and 2022 using the units-of-production method. c. Calculate depreciation expense for 2021 through 2025 using the double-declining balance method Complete this question by entering your answers in the tabs below. Calculate depreciation expense for 2021 and 2022 using the straight-line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts