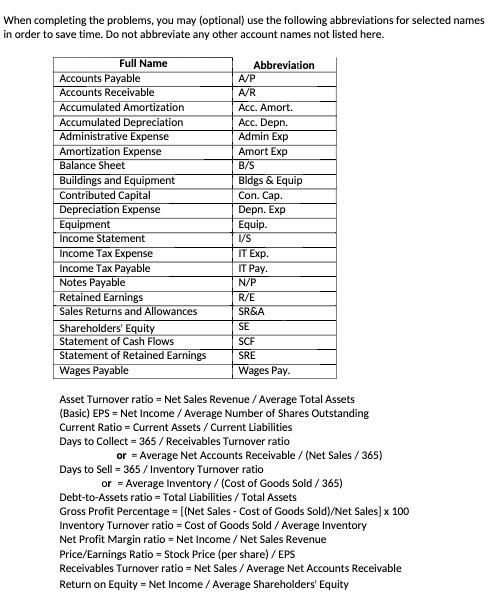

Question: When completing the problems, you may (optional) use the following abbreviations for selected names in order to save time. Do not abbreviate any other

When completing the problems, you may (optional) use the following abbreviations for selected names in order to save time. Do not abbreviate any other account names not listed here. Full Name Accounts Payable Accounts Receivable Accumulated Amortization Accumulated Depreciation Administrative Expense Amortization Expense Balance Sheet Buildings and Equipment Contributed Capital Depreciation Expense Equipment Income Statement Income Tax Expense Abbreviation A/P A/R Acc. Amort. Acc. Depn. B/S Admin Exp Amort Exp Bldgs & Equip Con. Cap. Depn. Exp Equip. I/S IT Exp. Income Tax Payable IT Pay. Notes Payable N/P Retained Earnings R/E Sales Returns and Allowances SR&A Shareholders' Equity SE Statement of Cash Flows SCF Statement of Retained Earnings SRE Wages Payable Wages Pay. Asset Turnover ratio = Net Sales Revenue / Average Total Assets (Basic) EPS Net Income / Average Number of Shares Outstanding Current Ratio = Current Assets/Current Liabilities Days to Collect=365/Receivables Turnover ratio or Average Net Accounts Receivable / (Net Sales/365) Days to Sell = 365/Inventory Turnover ratio or Average Inventory / (Cost of Goods Sold/365) Debt-to-Assets ratio = Total Liabilities/Total Assets Gross Profit Percentage = [(Net Sales - Cost of Goods Sold)/Net Sales] x 100 Inventory Turnover ratio = Cost of Goods Sold / Average Inventory Net Profit Margin ratio = Net Income / Net Sales Revenue Price/Earnings Ratio = Stock Price (per share) / EPS Receivables Turnover ratio = Net Sales / Average Net Accounts Receivable Return on Equity = Net Income / Average Shareholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts