Question: When Dorothy realized how small the margin was for her main product, she was aghast. She knew the company had already achieved significant direct materials

When Dorothy realized how small the margin was for her main product, she was aghast. She knew the company had already achieved significant direct materials savings by partnering with its supplier. The consultant brought in last year further streamlined labor usage, bringing her to bestinclass levels for labor. The only other area to look at was overhead.

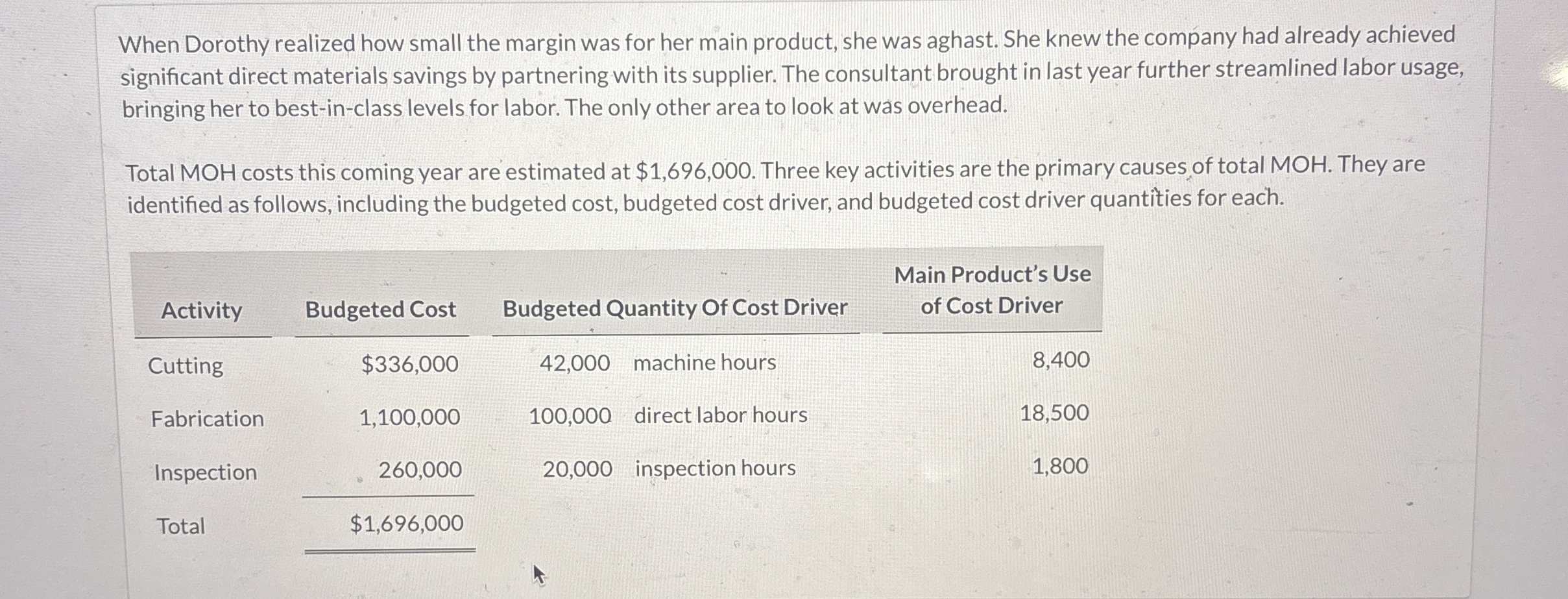

Total MOH costs this coming year are estimated at $ Three key activities are the primary causes of total MOH They are identified as follows, including the budgeted cost, budgeted cost driver, and budgeted cost driver quantities for each.

tableActivityBudgeted Cost,Budgeted Quantity Of Cost Driver,Main Product's Use of Cost DriverCutting$machine hours,Fabricationdirect labor hours,Inspectioninspection hours,Total$When Dorothy realized how small the margin was for her main product, she was aghast. She knew the company had already achieved significant direct materials savings by partnering with its supplier. The consultant brought in last year further streamlined labor usage, bringing her to bestinclass levels for labor. The only other area to look at was overhead.

Total MOH costs this coming year are estimated at $ Three key activities are the primary causes of total MOH. They are identified as follows, including the budgeted cost, budgeted cost driver, and budgeted cost driver quantities for each.

tableActivityBudgeted Cost,Budgeted Quantity Of Cost Driver,Main Product's Use of Cost DriverCutting$machine hours,Fabricationdirect labor hours,Inspectioninspection hours,Total$If the company instead breaks MOH into the key activities above, calculate the appropriate activity rates and subsequent allocated overhead cost to the main product.

tableActivitybased RateCutting$per machine hourFabrication$per DL hourInspection$per inspection hour

tableCuttingtableApplied MOH for ActivityFabricationInspectionTotal applied MOH

And for C find applied based rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock