Question: When Henry returns home from class, he finds a letter in his mailbox from his auto insurance company. He opens it, looks at it quickly,

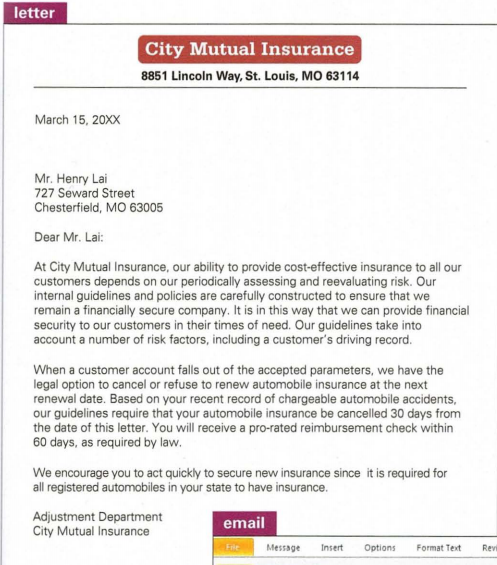

When Henry returns home from class, he finds a letter in his mailbox from his auto insurance company. He opens it, looks at it quickly, and then puts it aside. At first glance, the letter appears to be announcing a raise in premiums. He doesn't have time to read it carefully. Later that evening, though, he decides to pick it up again to read more carefully.(Letter is attached below)

Henry has to read the letter twice to understand what it means, and when he finally understands, he is shocked. This isn't what he expected at all! His family has had City Mutual Insurance since before he was born. How could the company drop him?

Question 2: A reader should be able to understand a bad-news message quickly-and not feel insulted or abandoned. How would you advise City Mutual to revise its letter? Explain the answer in more depth and in detail and also use the knowledge of business communication.

This is the letter which henry had received.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts