Question: When hourly rate employees work over 40 hours a week, the calculation of becomes necessary for the employer in a manufacturing concern. Overtime pay Overtime

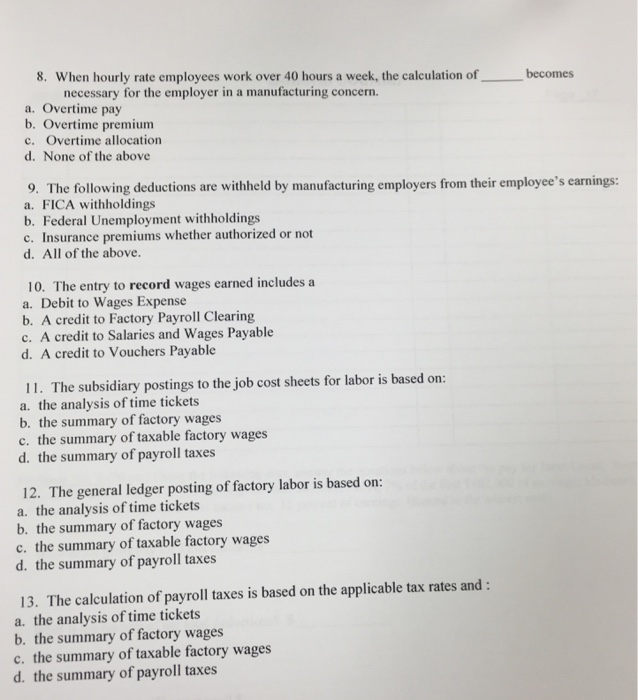

When hourly rate employees work over 40 hours a week, the calculation of becomes necessary for the employer in a manufacturing concern. Overtime pay Overtime premium Overtime allocation None of the above The following deductions are withheld by manufacturing employers from their employee's earnings: FICA withholdings Federal Unemployment withholdings Insurance premiums whether authorized or not All of the above. The entry to record wages earned includes a Debit to Wages Expense A credit to Factory Payroll Clearing A credit to Salaries and Wages Payable A credit to Vouchers Payable The subsidiary postings to the job cost sheets for labor is based on: the analysis of time tickets the summary of factory wages the summary of taxable factory wages the summary of payroll taxes The general ledger posting of factory labor is based on: the analysis of time tickets the summary of factory wages the summary of taxable factory wages the summary of payroll taxes The calculation of payroll taxes is based on the applicable tax rates and: the analysis of time tickets the summary of factory wages the summary of taxable factory wages the summary' of payroll taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts