Question: When I valued Reckitt Benckiser using the valuation model, the DFC and RIVM valuations were higher than the current stock price. The DDM valuation, on

When I valued Reckitt Benckiser using the valuation model, the DFC and RIVM valuations were higher than the current stock price. The DDM valuation, on the other hand, is lower than the current price.

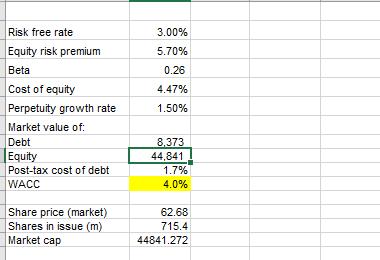

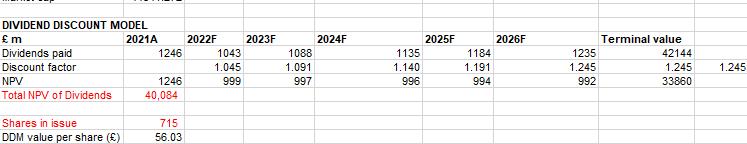

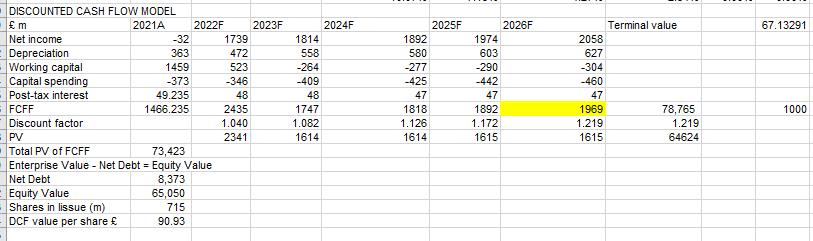

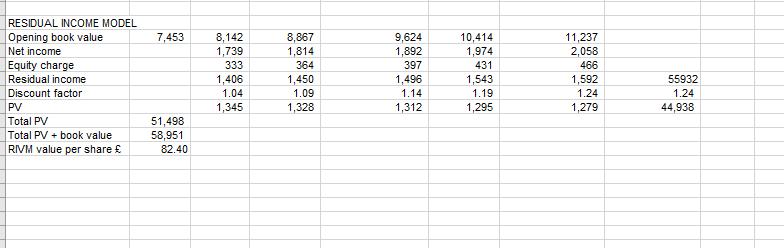

The current market price is 62 pounds and my DDM valuation is 58, my DCF valuation is 90 and my RIVM valuation is 82. Shouldn't all three models indicate an over-valuation over an under-valuatio?

Risk free rate Equity risk premium Beta Cost of equity Perpetuity growth rate Market value of: Debt Equity Post-tax cost of debt WACC Share price (market) Shares in issue (m) Market cap 3.00% 5.70% 0.26 4.47% 1.50% 8,373 44,841 1.7% 4.0% 62.68 715.4 44841.272

Step by Step Solution

There are 3 Steps involved in it

Dividend Discount Model DDM 1 Historical and forecasted dividends 2021 actual dividend 1246m 2022 fo... View full answer

Get step-by-step solutions from verified subject matter experts