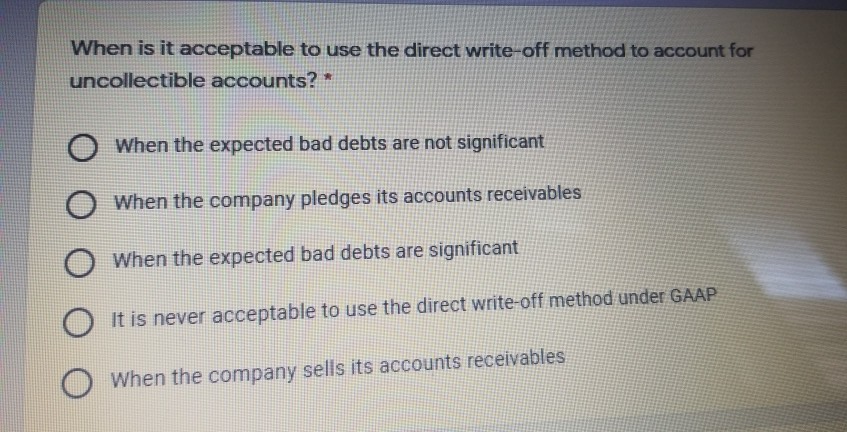

Question: When is it acceptable to use the direct write-off method to account for uncollectible accounts? * When the expected bad debts are not significant When

When is it acceptable to use the direct write-off method to account for uncollectible accounts? * When the expected bad debts are not significant When the company pledges its accounts receivables When the expected bad debts are significant It is never acceptable to use the direct write-off method under GAAP When the company sells its accounts receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts