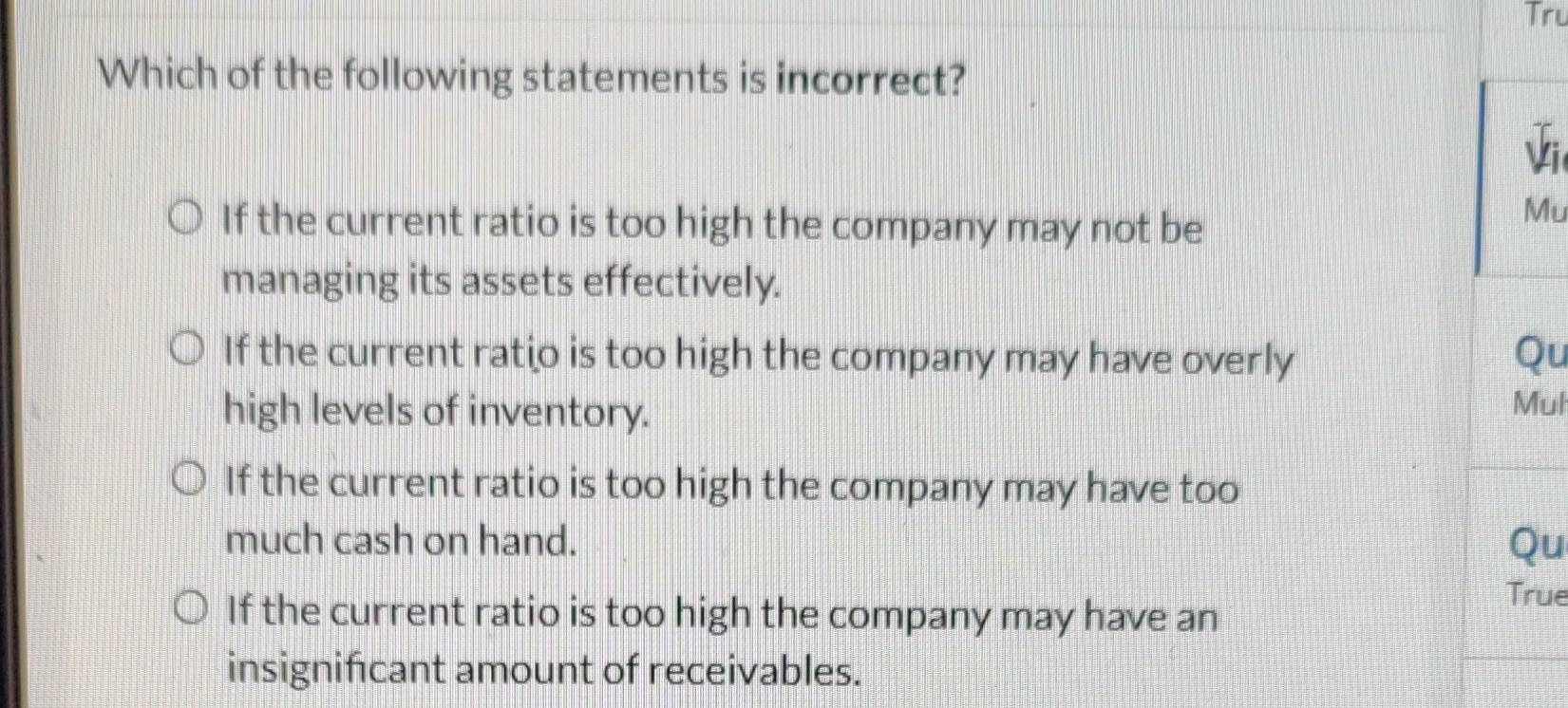

Question: Q10 answer the following multiple choice with the most correct answer Tru Which of the following statements is incorrect? Vic Mu Qu Mul O if

Q10 answer the following multiple choice with the most correct answer

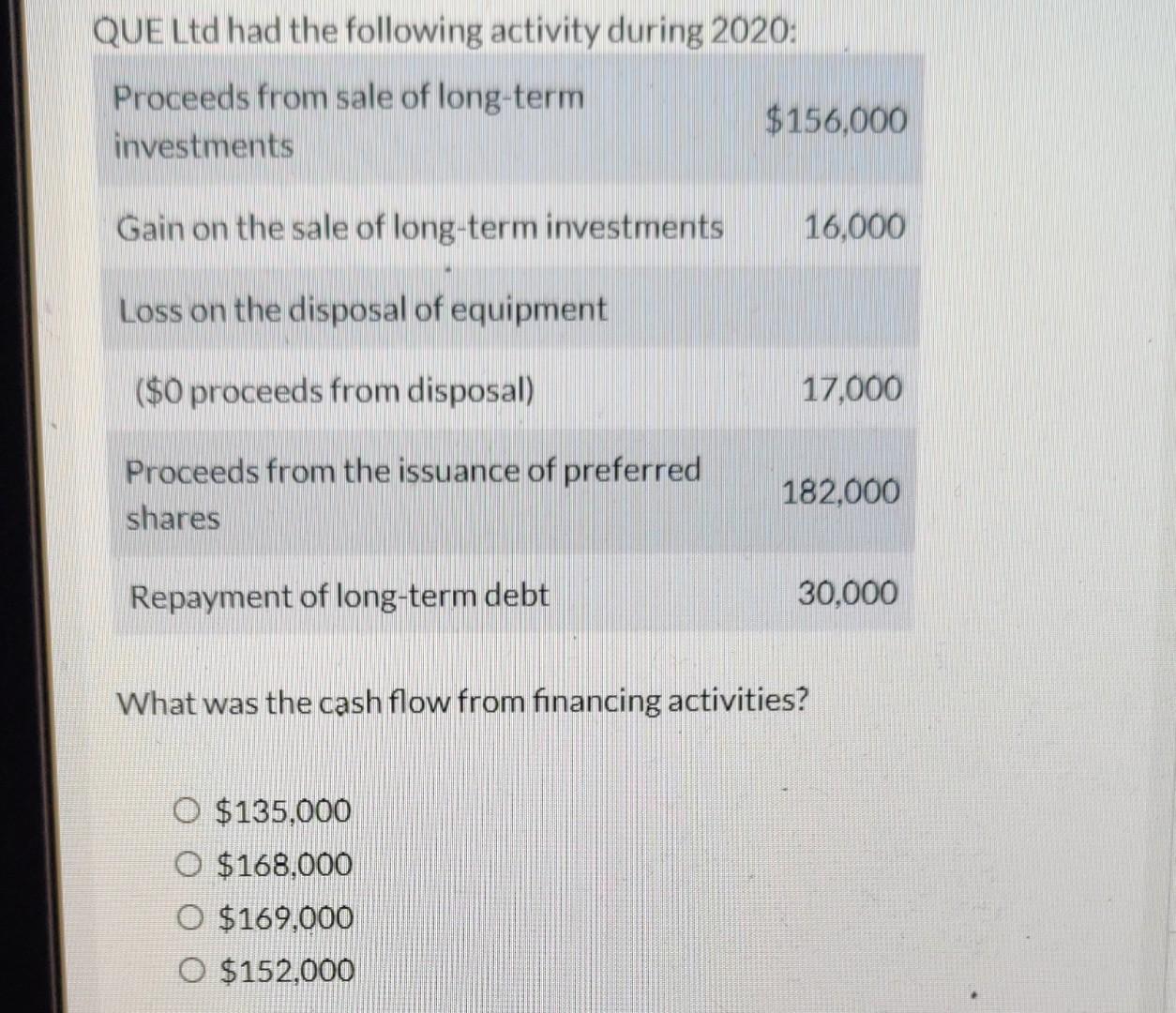

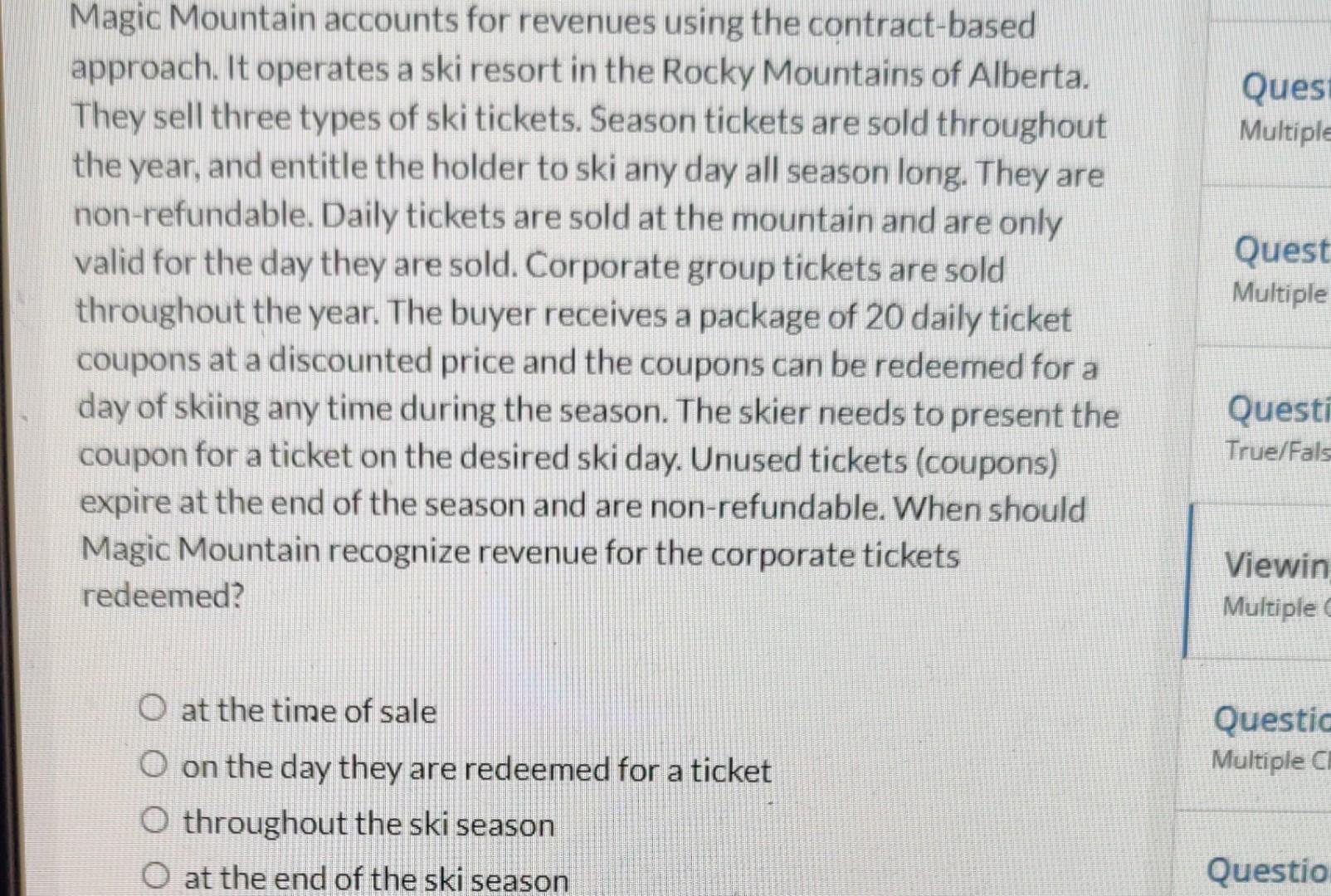

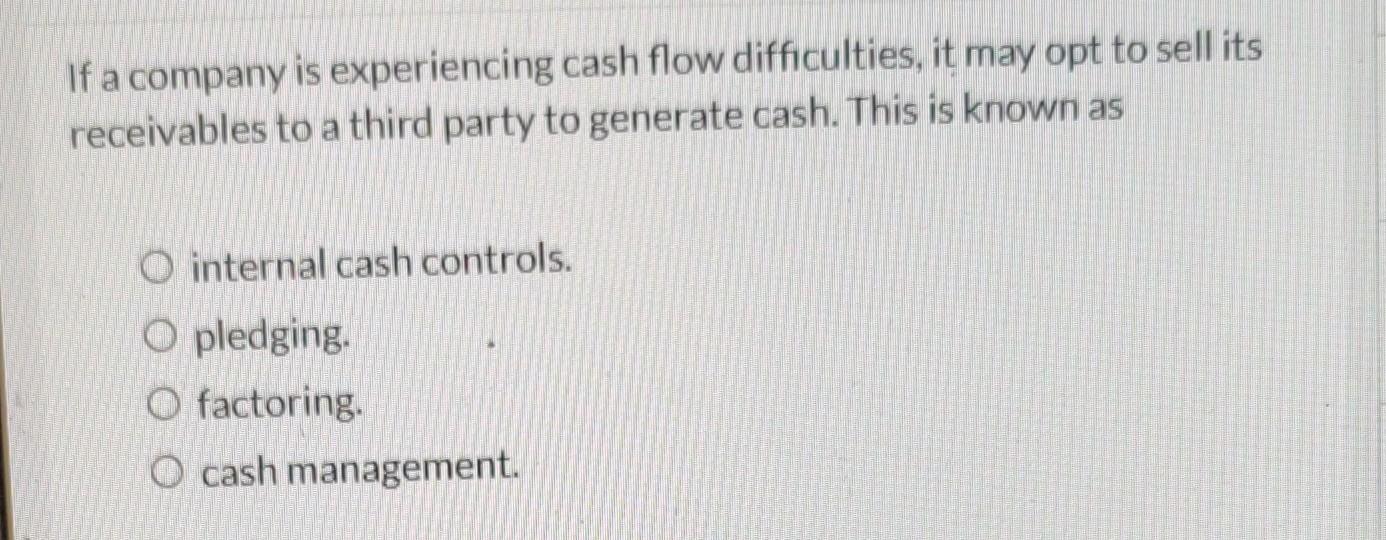

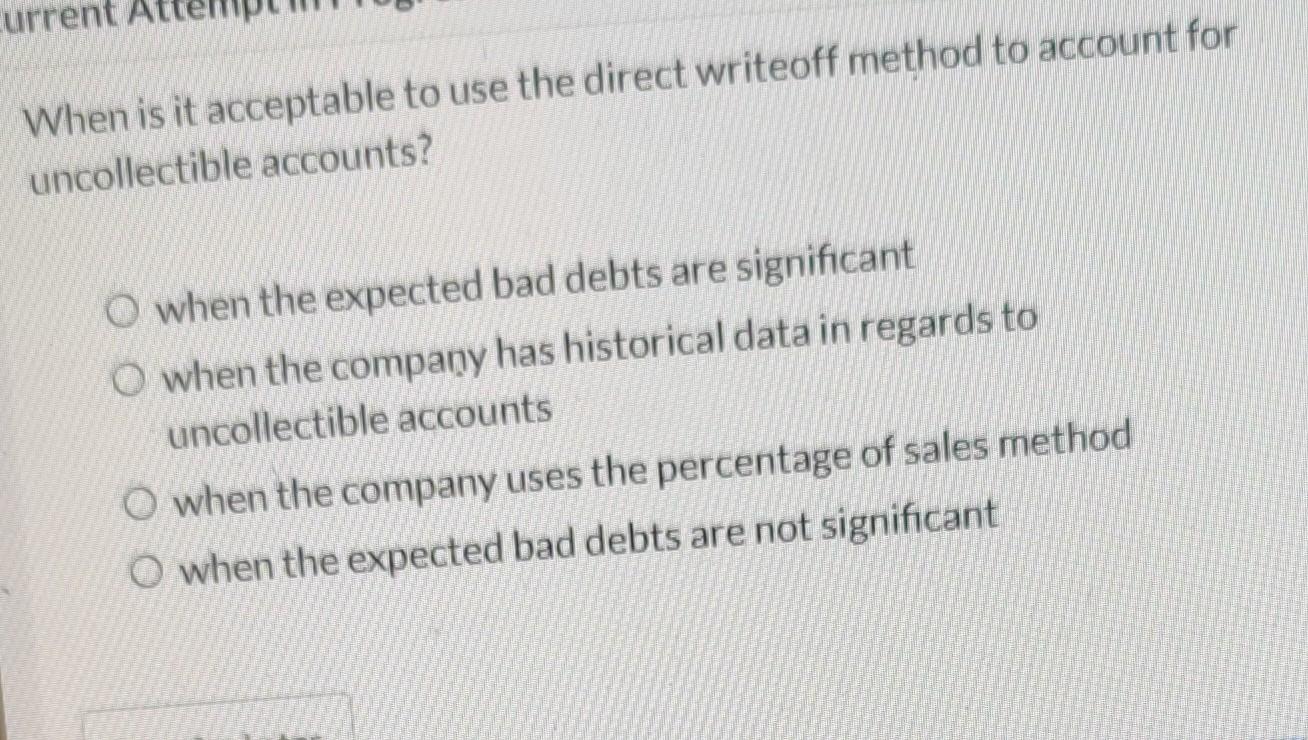

Tru Which of the following statements is incorrect? Vic Mu Qu Mul O if the current ratio is too high the company may not be managing its assets effectively. O if the current ratio is too high the company may have overly high levels of inventory. O If the current ratio is too high the company may have too much cash on hand. O If the current ratio is too high the company may have an insignificant amount of receivables. Qu True QUE Ltd had the following activity during 2020: Proceeds from sale of long-term $156,000 investments Gain on the sale of long-term investments 16,000 Loss on the disposal of equipment ($0 proceeds from disposal) 17.000 Proceeds from the issuance of preferred shares 182,000 Repayment of long-term debt 30,000 What was the cash flow from financing activities? O $135.000 O $168,000 O $169,000 O $152,000 Quest Multiple Magic Mountain accounts for revenues using the contract-based approach. It operates a ski resort in the Rocky Mountains of Alberta. They sell three types of ski tickets. Season tickets are sold throughout the year, and entitle the holder to ski any day all season long. They are non-refundable. Daily tickets are sold at the mountain and are only valid for the day they are sold. Corporate group tickets are sold throughout the year. The buyer receives a package of 20 daily ticket coupons at a discounted price and the coupons can be redeemed for a day of skiing any time during the season. The skier needs to present the coupon for a ticket on the desired ski day. Unused tickets (coupons) expire at the end of the season and are non-refundable. When should Magic Mountain recognize revenue for the corporate tickets redeemed? Quest Multiple a Questi True/Fals Viewin Multiple O at the time of sale Questid Multiple ci O on the day they are redeemed for a ticket O throughout the ski season O at the end of the ski season Questio If a company is experiencing cash flow difficulties, it may opt to sell its receivables to a third party to generate cash. This is known as O internal cash controls. O pledging. O factoring O cash management. current When is it acceptable to use the direct writeoff method to account for uncollectible accounts? O when the expected bad debts are significant O when the company has historical data in regards to uncollectible accounts when the company uses the percentage of sales method O when the expected bad debts are not significant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts