Question: When looking at the correlation of a pair of assets, we say the correlation is weak (and therefore good for diversification) if it is highly

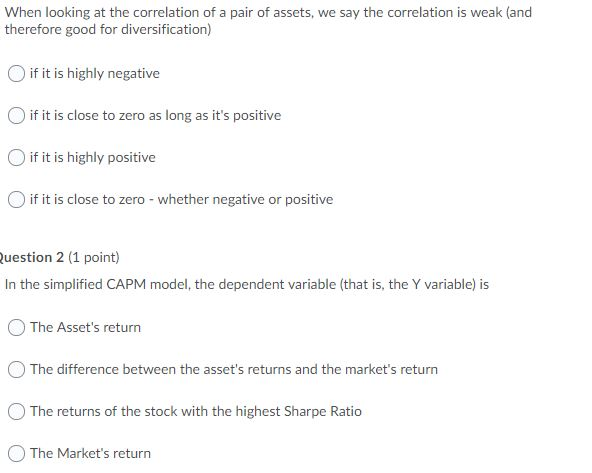

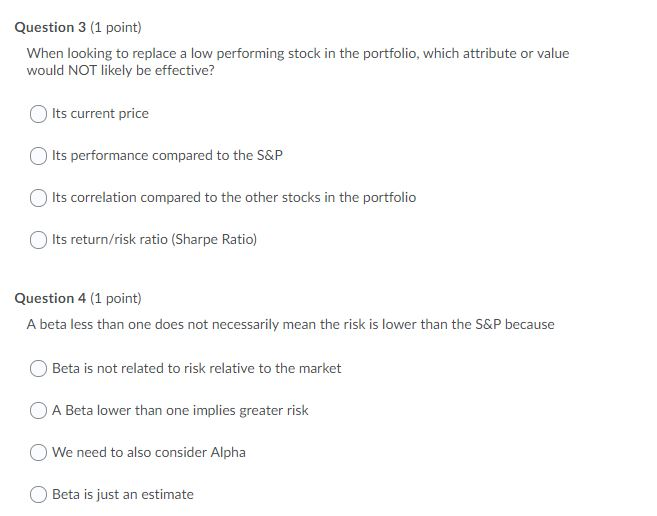

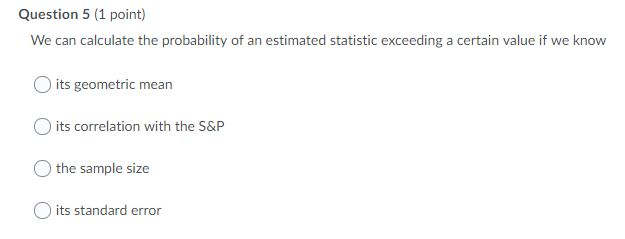

When looking at the correlation of a pair of assets, we say the correlation is weak (and therefore good for diversification) if it is highly negative if it is close to zero as long as it's positive if it is highly positive if it is close to zero - whether negative or positive Question 2 (1 point) In the simplified CAPM model, the dependent variable (that is, the Y variable) is The Asset's return The difference between the asset's returns and the market's return The returns of the stock with the highest Sharpe Ratio The Market's return Question 3 (1 point) When looking to replace a low performing stock in the portfolio, which attribute or value would NOT likely be effective? Its current price Its performance compared to the S&P Its correlation compared to the other stocks in the portfolio Its return/risk ratio (Sharpe Ratio) Question 4 (1 point) A beta less than one does not necessarily mean the risk is lower than the S&P because Beta is not related to risk relative to the market A Beta lower than one implies greater risk We need to also consider Alpha Beta is just an estimate Question 5 (1 point) We can calculate the probability of an estimated statistic exceeding a certain value if we know its geometric mean its correlation with the S&P O the sample size its standard error

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts