Question: When making large purchases, you usually pay a certain amount of the purchase up front ( called a down payment ) and then take a

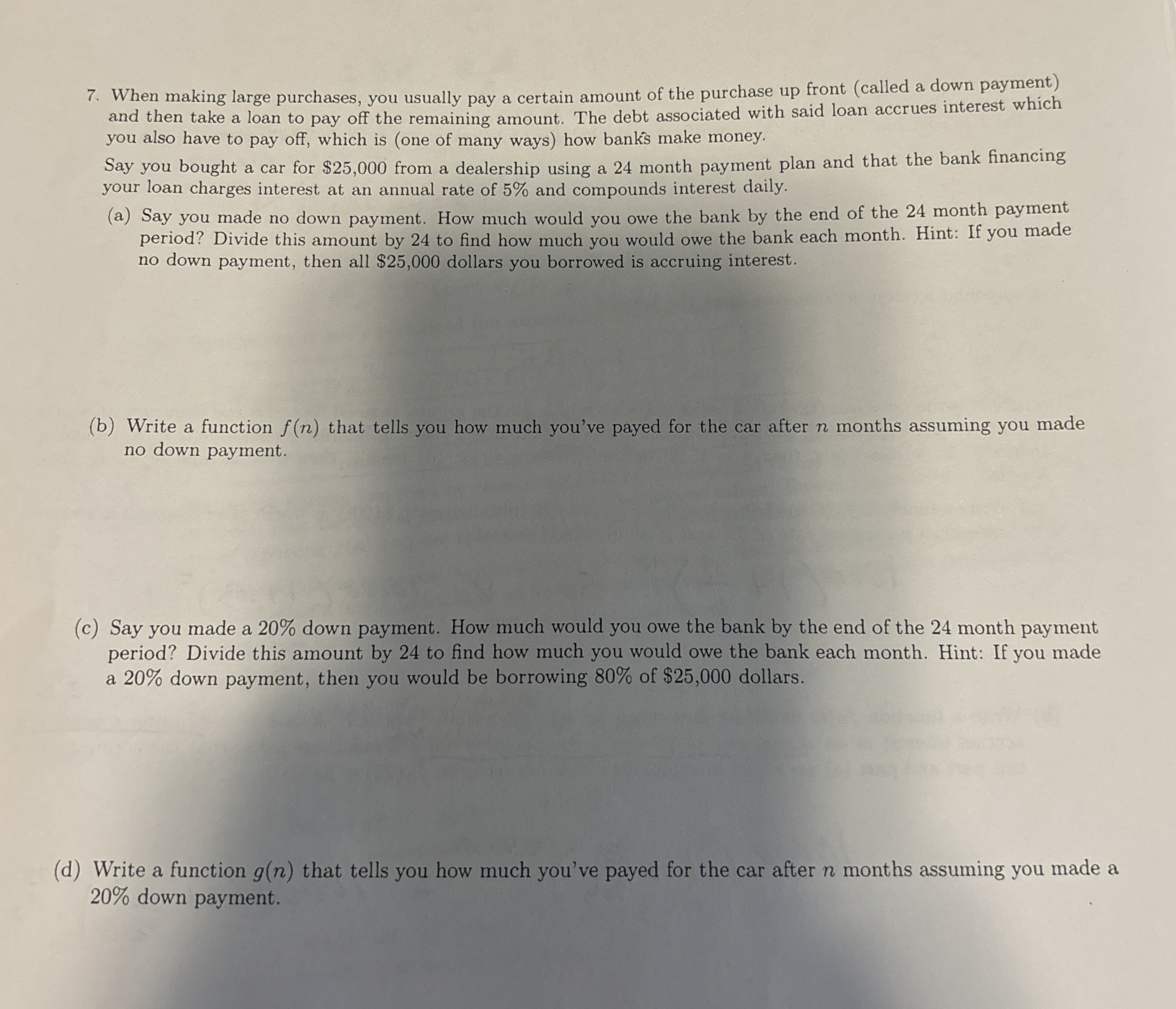

When making large purchases, you usually pay a certain amount of the purchase up front called a down payment and then take a loan to pay off the remaining amount. The debt associated with said loan accrues interest which you also have to pay off, which is one of many ways how banks make money.

Say you bought a car for $ from a dealership using a month payment plan and that the bank financing your loan charges interest at an annul rate of and compounds interest daily.

a Say you made no down payment. How much would you owe the bank by the end of the month payment period? Divide this amount by to find how much you would owe the bank each month. Hint: If you made no down payment, then all $ dollars you borrowed is accruing interest.

b Write a function that tells you how much you've payed for the car after months assuming you made no down payment.

c Say you made a down payment. How much would you owe the bank by the end of the month payment period? Divide this amount by to find how much you would owe the bank each month. Hint: If you made a down payment, then you would be borrowing of $ dollars.

d Write a function that tells you how much you've payed for the car after months assuming you made a down payment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock