Question: (*) When presenting the example of a voluntary information disclosed by a company, you should specify in separate paragraphs: Case study: Leasing contract Each group

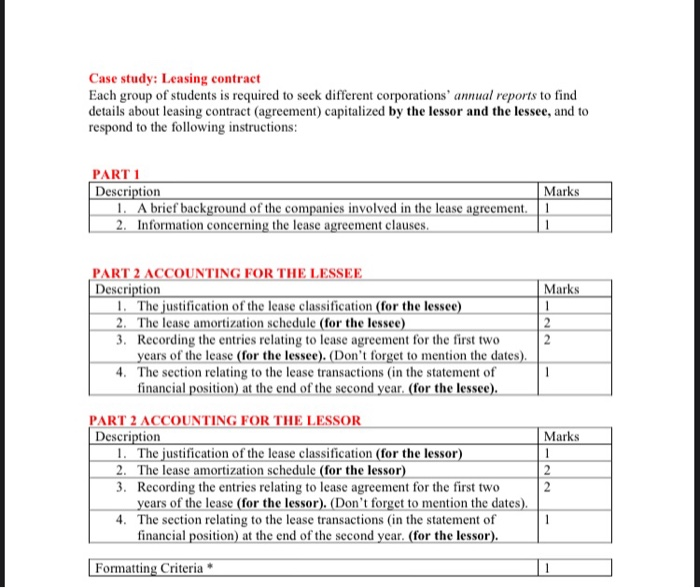

Case study: Leasing contract Each group of students is required to seek different corporations annual reports to find details about leasing contract (agreement) capitalized by the lessor and the lessee, and to respond to the following instructions: Marks PART 1 Description 1. A brief background of the companies involved in the lease agreement. 2. Information concerning the lease agreement clauses. Marks PART 2 ACCOUNTING FOR THE LESSEE Description 1. The justification of the lease classification (for the lessee) 2. The lease amortization schedule (for the lessee) 3. Recording the entries relating to lease agreement for the first two years of the lease (for the lessee). (Don't forget to mention the dates). 4. The section relating to the lease transactions in the statement of financial position) at the end of the second year. (for the lessee). Marks PART 2 ACCOUNTING FOR THE LESSOR Description 1. The justification of the lease classification (for the lessor) 2. The lease amortization schedule (for the lessor) 3. Recording the entries relating to lease agreement for the first two years of the lease (for the lessor). (Don't forget to mention the dates). 4. The section relating to the lease transactions in the statement of financial position) at the end of the second year. (for the lessor). Formatting Criteria * Case study: Leasing contract Each group of students is required to seek different corporations annual reports to find details about leasing contract (agreement) capitalized by the lessor and the lessee, and to respond to the following instructions: Marks PART 1 Description 1. A brief background of the companies involved in the lease agreement. 2. Information concerning the lease agreement clauses. Marks PART 2 ACCOUNTING FOR THE LESSEE Description 1. The justification of the lease classification (for the lessee) 2. The lease amortization schedule (for the lessee) 3. Recording the entries relating to lease agreement for the first two years of the lease (for the lessee). (Don't forget to mention the dates). 4. The section relating to the lease transactions in the statement of financial position) at the end of the second year. (for the lessee). Marks PART 2 ACCOUNTING FOR THE LESSOR Description 1. The justification of the lease classification (for the lessor) 2. The lease amortization schedule (for the lessor) 3. Recording the entries relating to lease agreement for the first two years of the lease (for the lessor). (Don't forget to mention the dates). 4. The section relating to the lease transactions in the statement of financial position) at the end of the second year. (for the lessor). Formatting Criteria *

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts