Question: When purchasing a $120,000 house, a borrower is comparing two loan alternatives. The first loan is a 90% loan at 12% for 25 years. The

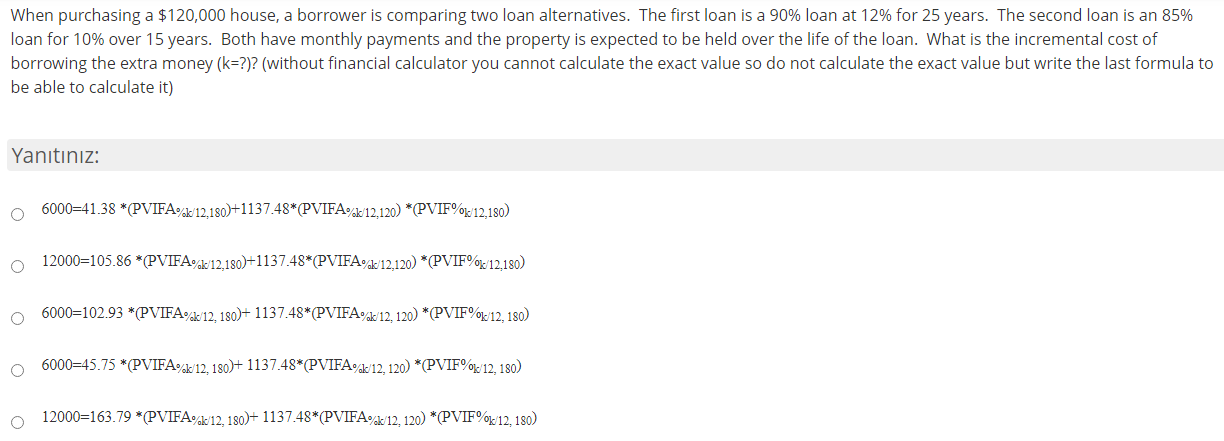

When purchasing a $120,000 house, a borrower is comparing two loan alternatives. The first loan is a 90% loan at 12% for 25 years. The second loan is an 85% loan for 10% over 15 years. Both have monthly payments and the property is expected to be held over the life of the loan. What is the incremental cost of borrowing the extra money (k=?)? (without financial calculator you cannot calculate the exact value so do not calculate the exact value but write the last formula to be able to calculate it) Yanitiniz: 0 6000=41.38 *(PVIFA%\/12,180)+1137.48*(PVIFA%k/12,120) *PVIF%/12,180) O 12000=105.86 *(PVIFA%k: 12,180)+1137.48*(PVIFA0k/12,120) *PVIF%x12,180) 6000=102.93 *PVIFA):12, 180)+ 1137.48*PVIFAak/12, 120) *PVIF%9v/12, 180) O 6000=45.75 *(PVIFA%k/12, 180)+ 1137.48*(PVIFAK/12, 120) *(PVIF/12, 180) 12000=163.79 * (PVIFA%k/12, 180)+1137.48*(PVIFA%k:/12, 120) * (PVIF%\/12, 180)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts