Question: When someone quotes you a spot rate, when would borrowing or lending begin? O now O in the future O in the past Question

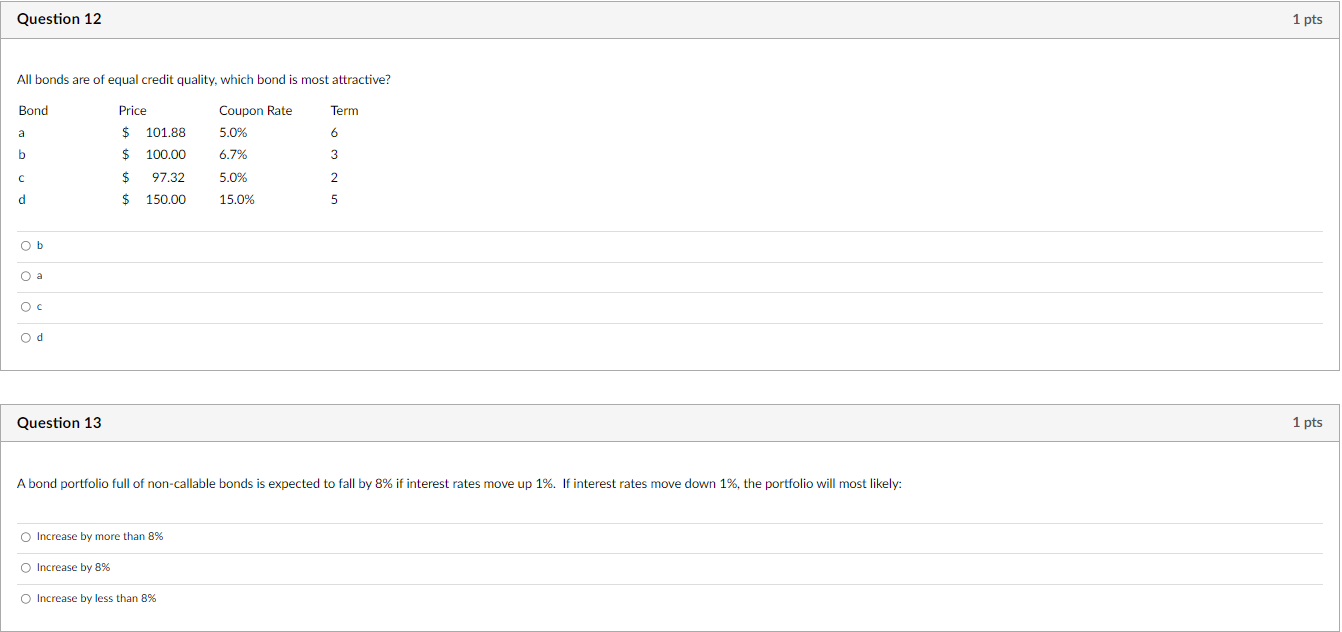

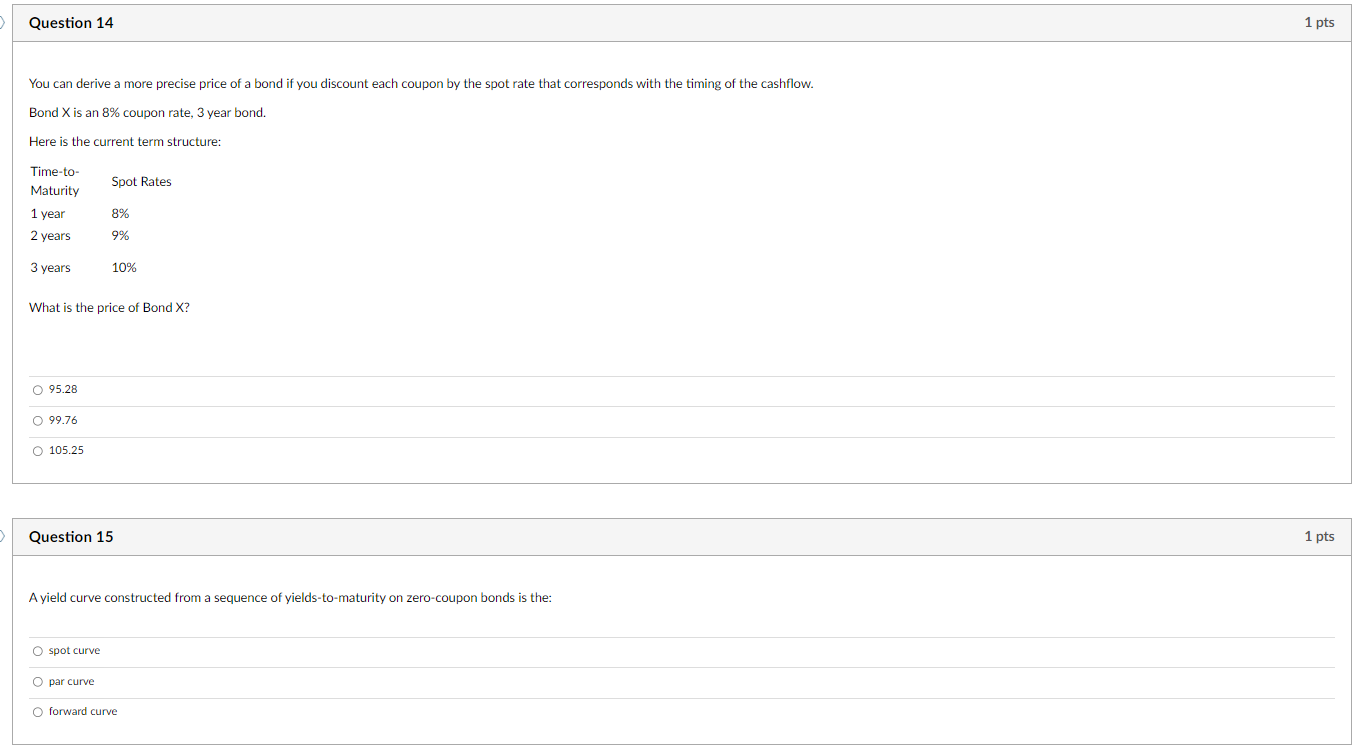

When someone quotes you a "spot rate," when would borrowing or lending begin? O now O in the future O in the past Question 3 If market interest rates for BBB debt are 6%, and GM (a BBB issuer) issues a bond with a 5% coupon, the bond will likely trade: O at a discount. O at par O at a premium Question 4 The yield-to-maturity of a bond is the same as the: O internal rate of return O risk-free rate. O market risk premium Question 5 When an investor is looking for a real return of 5% and inflation is expected to be 2%, what nominal yield would the investor require? O 7% O 3% O 5% 1 pts 1 pts 1 pts Question 6 The relationship between the price of a bond and the market interest rate is usually what (if the bond is not callable): O convex O linear O sinusoidal Question 7 Your broker quotes a bond to you at $101.23. You decide to buy 10 bonds for $1012.30. Will your broker accept your payment? O No, you must include accrued interest O No, each bond is $1000, so you will need to send him at least $10,123 O All of the above Question 8 What is the difference between yield-to-maturity and yield-to-worst? O Yield-to-worst is return for bond if it gets called on the first possible call date O Yield-to-worst is return if the bond defaults O Yield-to-worst doesn't include interest payments 1 pts 1 pts 1 pts Question 9 Jimmy owns a bond with a 9% coupon that matures in three years. If the required rate of return on the bond is 11%, the price of the bond per 100 of par value is closest to: O 95 O 100 O 105 Question 10 A bond offers an annual coupon rate of 6%, with interest paid semiannually. The bond matures in eight years. At a market discount rate of 3%, the price of this bond per 100 of par value is closest to: O 121 O 100 O 79 Question 11 Reputable bond dealers most often quote: O The flat price O The full price O The full price plus accrued interest 1 pts 1 pts 1 pts Question 12 All bonds are of equal credit quality, which bond is most attractive? Coupon Rate 5.0% 6.7% 5.0% 15.0% Bond a b d O b O a Oc Od Question 13 Price $ 101.88 $ 100.00 $ 97.32 $ 150.00 A bond portfolio full of non-callable bonds is expected to fall by 8% if interest rates move up 1%. If interest rates move down 1%, the portfolio will most likely: O Increase by more than 8% O Increase by 8% Term 6 3 2 5 O Increase by less than 8% 1 pts 1 pts D Question 14 You can derive a more precise price of a bond if you discount each coupon by the spot rate that corresponds with the timing of the cashflow. Bond X is an 8% coupon rate, 3 year bond. Here is the current term structure: Time-to- Maturity 1 year 2 years 3 years O 95.28 O 99.76 O 105.25 What is the price of Bond X? Spot Rates 8% 9% O spot curve 10% Question 15 O par curve A yield curve constructed from a sequence of yields-to-maturity on zero-coupon bonds is the: O forward curve 1 pts 1 pts

Step by Step Solution

There are 3 Steps involved in it

Answer 1 When someone quotes you a spot rate borrowing or lending would begin now Spot rates represent the current interest rates for borrowing or lending funds in the financial markets So if someone ... View full answer

Get step-by-step solutions from verified subject matter experts