Question: When the correlation between stocks is 0 and -0.9, how and why does the shape of your investment opportunity set change? 12.00% 10.00% 8.00% 6.00%

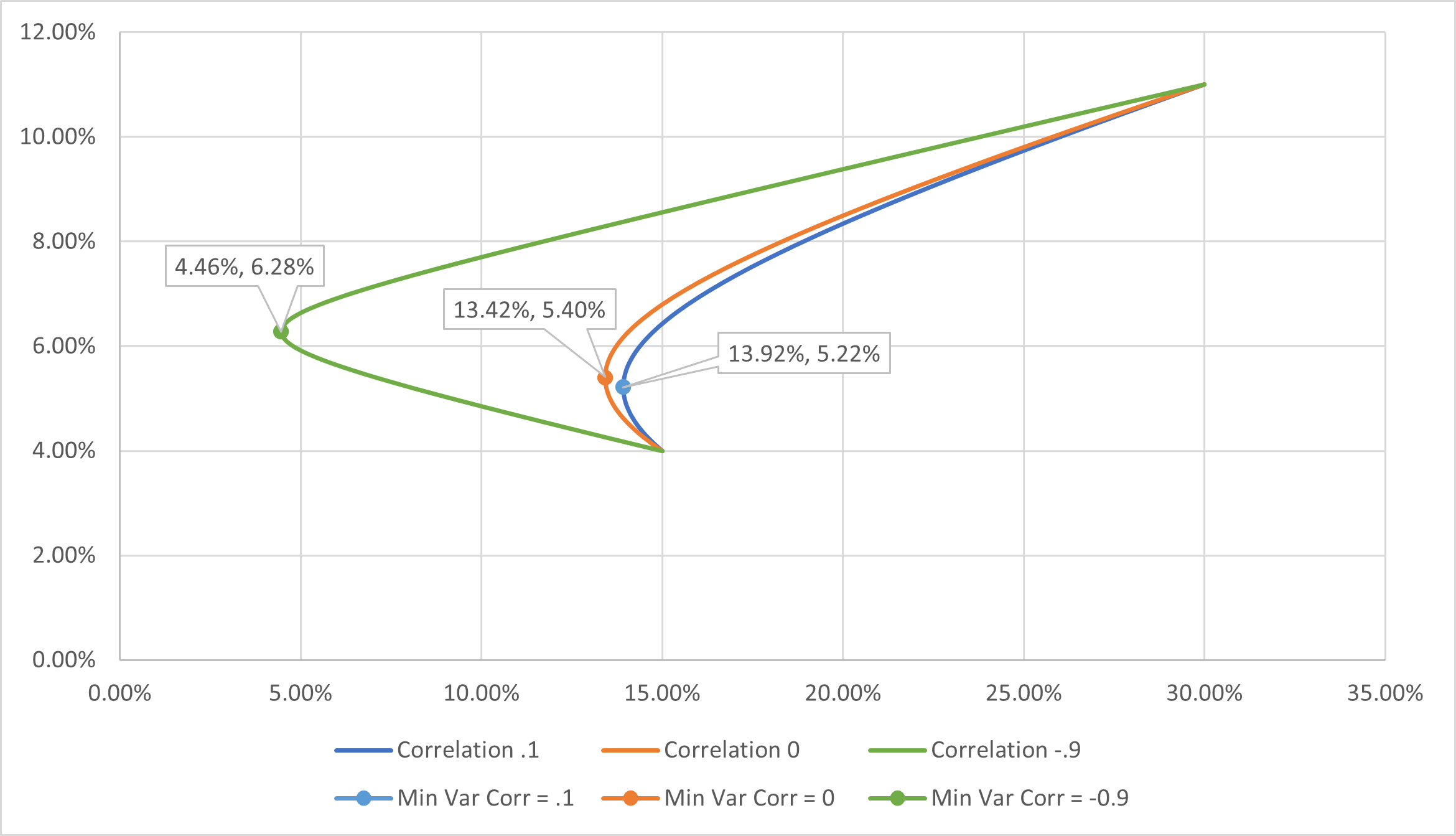

When the correlation between stocks is 0 and -0.9, how and why does the shape of your investment opportunity set change?

12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 0.00% 4.46%, 6.28% 5.00% 13.42%, 5.40% 10.00% Correlation .1 Min Var Corr = .1 15.00% 13.92%, 5.22% 20.00% Correlation 0 Min Var Corr = 0 25.00% Correlation -.9 Min Var Corr = -0.9 30.00% 35.00%

Step by Step Solution

There are 3 Steps involved in it

The investment opportunity set refers to the set of all possible combinations of assets in a portfolio that an investor can choose from to achieve a p... View full answer

Get step-by-step solutions from verified subject matter experts