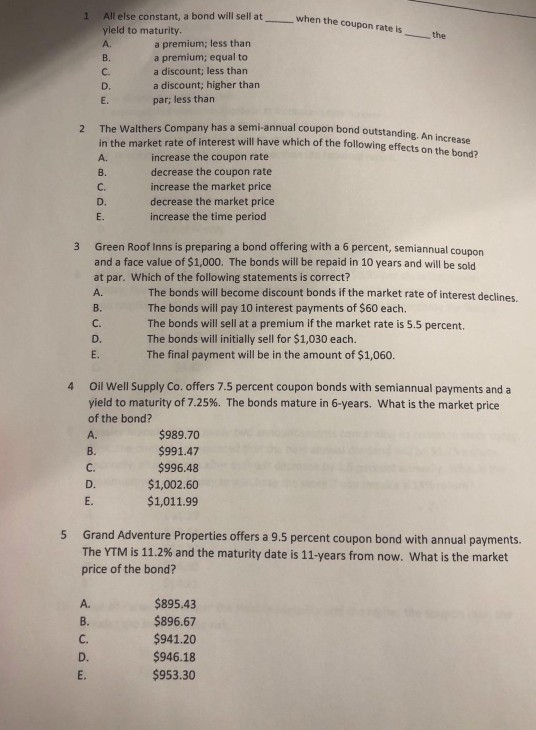

Question: when the coupon the All else constant, a bond will sell at yield to maturity a premium; less than a premium; equal to a discount;

when the coupon the All else constant, a bond will sell at yield to maturity a premium; less than a premium; equal to a discount; less than D. a discount; higher than par; less than . 4 The Walthers Company has a semi-annual coupon bond outstanding tanding. An increase in the market rate of interest will have which of the following effects which of the following effects on the bond? increase the coupon rate decrease the coupon rate increase the market price decrease the market price increase the time period Green Roof Inns is preparing a bond offering with a 6 percent, semiannual coupon and a face value of $1,000. The bonds will be repaid in 10 years and will be sold at par. Which of the following statements is correct? The bonds will become discount bonds if the market rate of interest declines. The bonds will pay 10 interest payments of $60 each. The bonds will sell at a premium if the market rate is 5.5 percent. The bonds will initially sell for $1,030 each. The final payment will be in the amount of $1,060. Oil Well Supply Co. offers 7.5 percent coupon bonds with semiannual payments and a yield to maturity of 7.25%. The bonds mature in 6-years. What is the market price of the bond? $989.70 $991.47 $996.48 $1,002.60 $1,011.99 5 Grand Adventure Properties offers a 9.5 percent coupon bond with annual payments. The YTM is 11.2% and the maturity date is 11-years from now. What is the market price of the bond? U. $895.43 $896.67 $941.20 $946.18 $953.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts