Question: When using the binomial model with futures contracts as the underlying asset, how does one determine the dividend rate to use in the binomial model

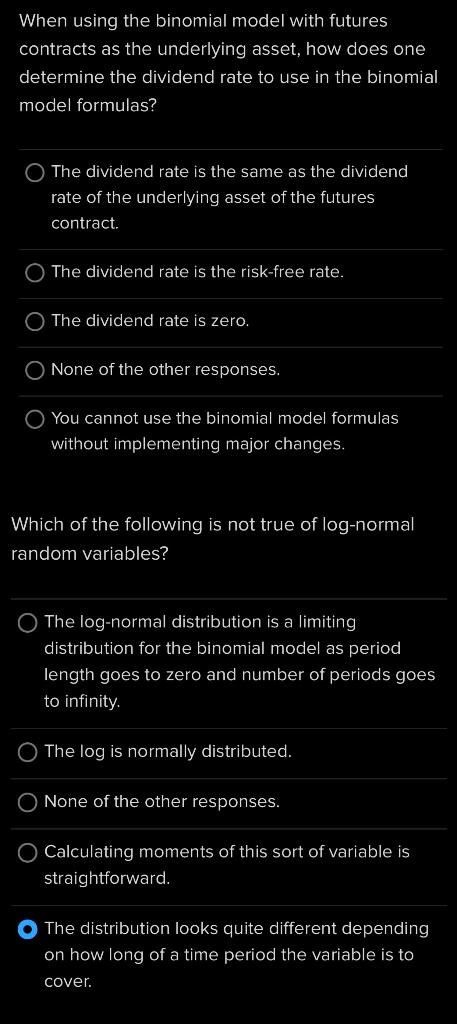

When using the binomial model with futures contracts as the underlying asset, how does one determine the dividend rate to use in the binomial model formulas? The dividend rate is the same as the dividend rate of the underlying asset of the futures contract. The dividend rate is the risk-free rate. The dividend rate is zero. None of the other responses. You cannot use the binomial model formulas without implementing major changes. Which of the following is not true of log-normal random variables? The log-normal distribution is a limiting distribution for the binomial model as period length goes to zero and number of periods goes to infinity. The log is normally distributed. None of the other responses. Calculating moments of this sort of variable is straightforward. The distribution looks quite different depending on how long of a time period the variable is to cover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts