Question: When using the LCM rule in Canada, the market value is most commonly 1) net present value. 2) replacement cost. 3) selling price less profit

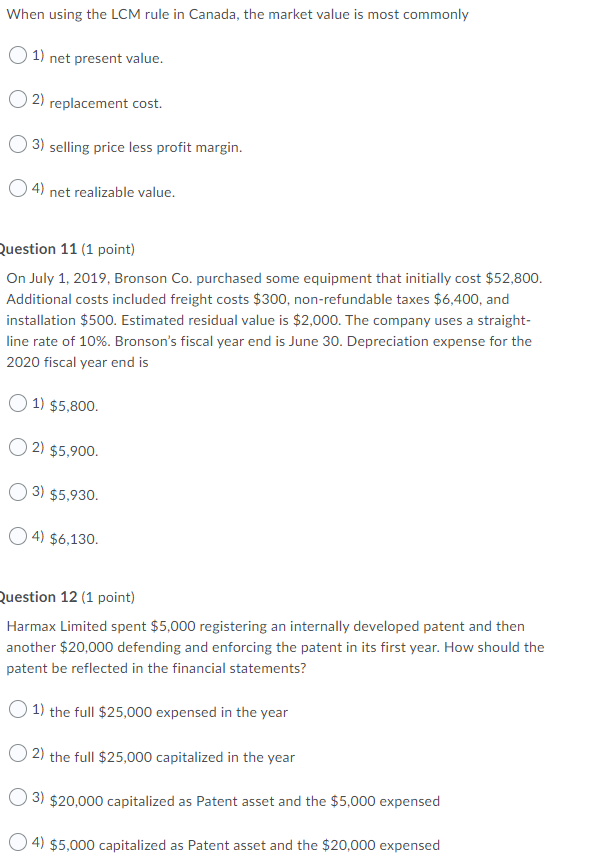

When using the LCM rule in Canada, the market value is most commonly 1) net present value. 2) replacement cost. 3) selling price less profit margin. 4) net realizable value. Question 11 (1 point) On July 1, 2019, Bronson Co. purchased some equipment that initially cost $52,800. Additional costs included freight costs $300, non-refundable taxes $6,400, and installation $500. Estimated residual value is $2,000. The company uses a straight- line rate of 10%. Bronson's fiscal year end is June 30. Depreciation expense for the 2020 fiscal year end is 1) $5,800 2) $5,900. 3) $5.930. 4) $6,130. Question 12 (1 point) Harmax Limited spent $5,000 registering an internally developed patent and then another $20,000 defending and enforcing the patent in its first year. How should the patent be reflected in the financial statements? 1) the full $25,000 expensed in the year 2) the full $25,000 capitalized in the year 3) $20,000 capitalized as Patent asset and the $5,000 expensed 4) $5,000 capitalized as Patent asset and the $20,000 expensed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts