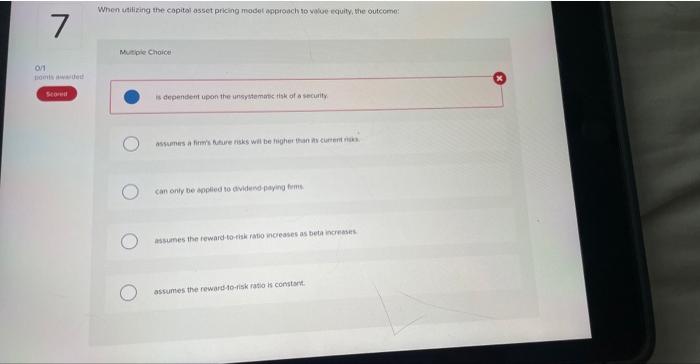

Question: When utilizing the capital asset pricing model approach to value equity, the outcome: Muttipte Choice is dependent upon the unsystematic risk of a security assumes

When utilizing the capital asset pricing model approach to value equity, the outcome: Muttipte Choice is dependent upon the unsystematic risk of a security assumes a firm's future risks wid be higher than its curtent risks. can only be applied to dividend-paying firms. assumes the reward-to-risk rotio increases as beta increases. When utilizing the capitol asset pricing modet approach lo valoe equity, the outcome: Mutipie Choice is depensemt upan the urssstemate tiak of a security assumes a firms hare risks will be fogher than av curtenit rian can anty be applied to dividend paying frmm assumes the feward to-tak rato noreases as beta increases. assumes the reward 404 sk ratio is comstart

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts