Question: When we evaluate a long hedger, their situation is opposite to that of a short hedger. The short hedger grows and sells the commodity whereas,

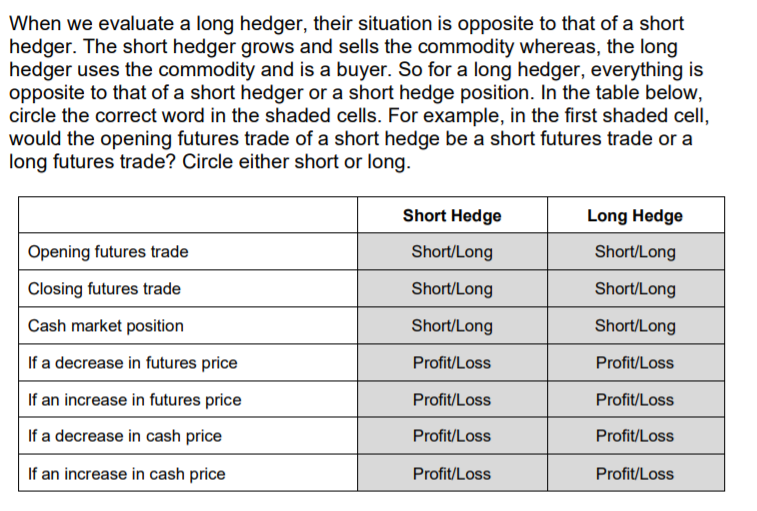

When we evaluate a long hedger, their situation is opposite to that of a short hedger. The short hedger grows and sells the commodity whereas, the long hedger uses the commodity and is a buyer. So for a long hedger, everything is opposite to that of a short hedger or a short hedge position. In the table below, circle the correct word in the shaded cells. For example, in the first shaded cell, would the opening futures trade of a short hedge be a short futures trade or a long futures trade? Circle either short or long.

When we evaluate a long hedger, their situation is opposite to that of a short hedger. The short hedger grows and sells the commodity whereas, the long hedger uses the commodity and is a buyer. So for a long hedger, everything is opposite to that of a short hedger or a short hedge position. In the table below, circle the correct word in the shaded cells. For example, in the first shaded cell, would the opening futures trade of a short hedge be a short futures trade or a long futures trade? Circle either short or long. Short Hedge Short/Long Long Hedge Short/Long Opening futures trade Closing futures trade Short/Long Short/Long Cash market position Short/Long Short/Long If a decrease in futures price Profit/Loss Profit/Loss If an increase in futures price Profit/Loss Profit/Loss If a decrease in cash price Profit/Loss Profit/Loss If an increase in cash price Profit/Loss Profit/Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts