Question: can u please do 34,35 im confused on both U=5 Compute how much a business is worth if it is expected to generate cash flows

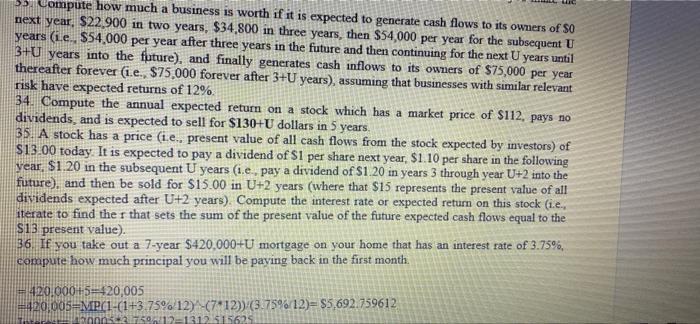

Compute how much a business is worth if it is expected to generate cash flows to its owners of So next year. $22.900 in two years, $34,800 in three years, then $54,000 per year for the subsequent U years (i.e., $54,000 per year after three years in the future and then continuing for the next U 3+U years into the future), and finally generates cash inflows to its owners of $75,000 per year years until thereafter forever (i.e., $75,000 forever after 3+U years), assuming that businesses with similar relevant risk have expected returns of 12% 34. Compute the annual expected return on a stock which has a market price of $112, pays no dividends, and is expected to sell for $130+U dollars in 5 years 35. A stock has a price (i... present value of all cash flows from the stock expected by investors) of $13.00 today. It is expected to pay a dividend of $1 per share next year, $1.10 per share in the following year $1.20 in the subsequent U years (i.e., pay a dividend of $1.20 in years 3 through year U+2 into the future), and then be sold for $15.00 in U+2 years (where that $15 represents the present value of all dividends expected after U+2 years) Compute the interest rate or expected return on this stock (i.e. iterate to find the r that sets the sum of the present value of the future expected cash flows equal to the S13 present value) 36. If you take out a 7-year $420,000+U mortgage on your home that has an interest rate of 3.75%, compute how much principal you will be paving back in the first month. = 420.00015-420,005 420.005=MP(1-(1+3.75% 12) (7-12) (3.75% 12)= $5,692759612 n.12. 11512-1312515625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts