Question: When we maximize the objective function, Sp, we have to satisfy the constraint that the portfolio weights sum to 1,0 (100%), that is, wD +

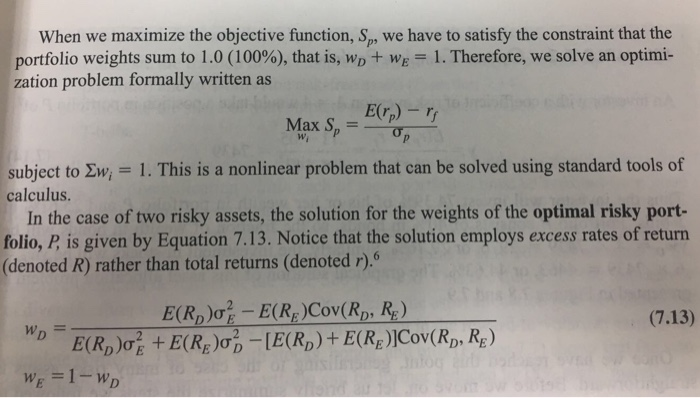

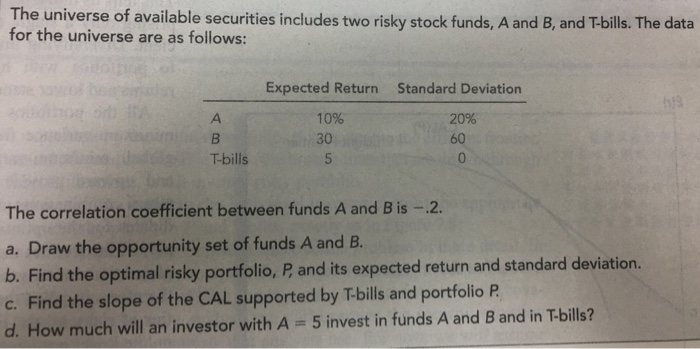

When we maximize the objective function, Sp, we have to satisfy the constraint that the portfolio weights sum to 1,0 (100%), that is, wD + We-1. Therefore, we solve an optimi- zation problem formally written as E(rp) - 2w, 1. This is a nonlinear problem that can be solved using standard tools of subject to calculus. In the case of two risky assets, the solution for the weights of the optimal risky port- folio, P is given by Equation 7.13. Notice that the solution employs excess rates of return (denoted R) rather than total returns (denoted r). (7.13) The universe of available securities includes two risky stock funds, A and B, and T-bills. The data for the universe are as follows: Expected Return Standard Deviation 10% 20% 30 60 T-bills The correlation coefficient between funds A and B is -2 a. Draw the opportunity set of funds A and B. b. Find the optimal risky portfolio, P and its expected return and standard deviation. c. Find the slope of the CAL supported by T-bills and portfolio P d. How much will an investor with A 5 invest in funds A and B and in T-bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts