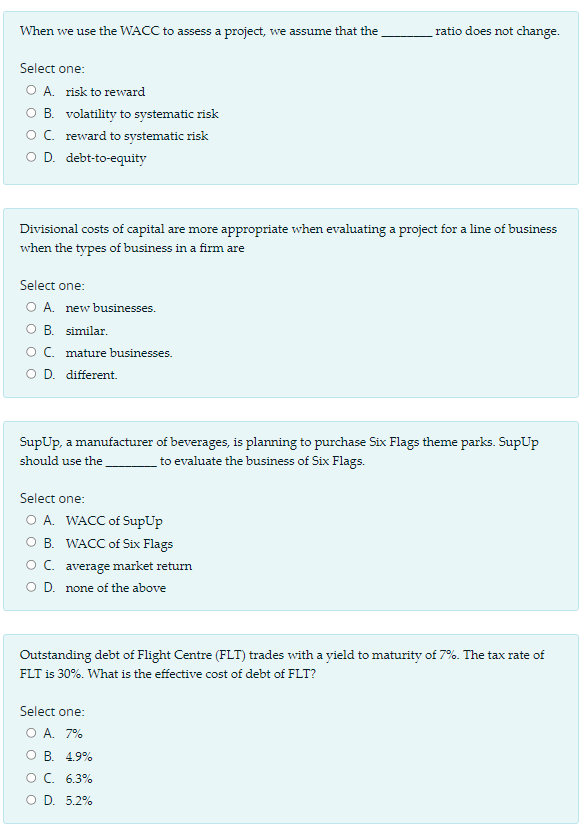

Question: When we use the WACC to assess a project, we assume that the ratio does not change. Select one: O A. risk to reward OB.

When we use the WACC to assess a project, we assume that the ratio does not change. Select one: O A. risk to reward OB. volatility to systematic risk OC reward to systematic risk OD. debt-to-equity Divisional costs of capital are more appropriate when evaluating a project for a line of business when the types of business in a firm are Select one: O A new businesses. OB. similar. OC. mature businesses. O D. different. SupUp, a manufacturer of beverages, is planning to purchase Six Flags theme parks. SupUp should use the to evaluate the business of Six Flags. Select one: OA WACC of SupUp OB. WACC of Six Flags OC. average market return OD. none of the above Outstanding debt of Flight Centre (FLT) trades with a yield to maturity of 7%. The tax rate of FLT is 30%. What is the effective cost of debt of FLT? Select one: O A 7% OB 4.9% O C. 6.3% OD. 5.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts