Question: when you construct a market- value index you put more money in firms with a high market capitalization you put the same amount of money

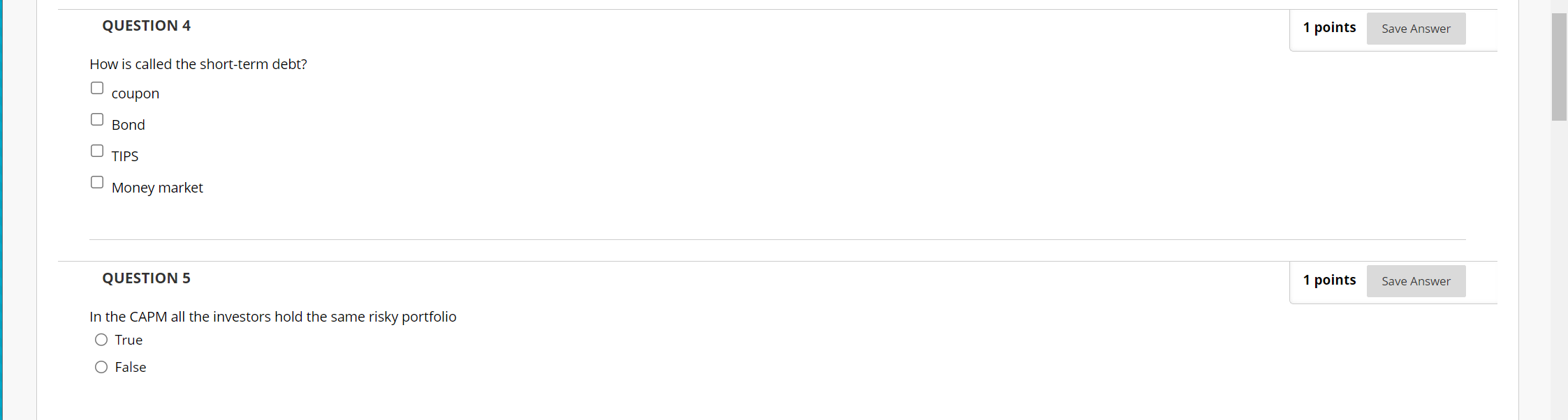

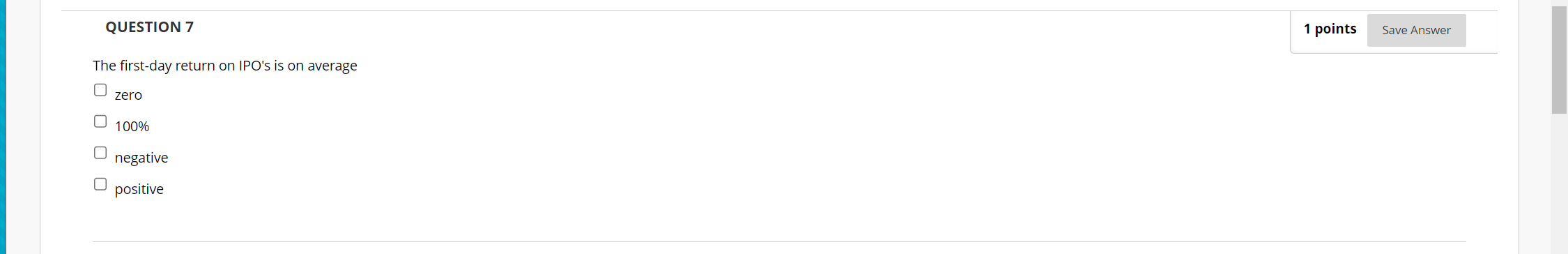

when you construct a market- value index you put more money in firms with a high market capitalization you put the same amount of money in all stocks you always have a positive return you put more money in stocks with a high price How is called the short-term debt? coupon Bond TIPS Money market QUESTION 5 In the CAPM all the investors hold the same risky portfolio True False The first-day return on IPO's is on average zero 100% negative positive when you construct a market- value index you put more money in firms with a high market capitalization you put the same amount of money in all stocks you always have a positive return you put more money in stocks with a high price How is called the short-term debt? coupon Bond TIPS Money market QUESTION 5 In the CAPM all the investors hold the same risky portfolio True False The first-day return on IPO's is on average zero 100% negative positive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts