Question: Suppose there is an environmental disaster which will occur in 50 years which, if left unchecked. will cause $50 trillion of damage. It costs

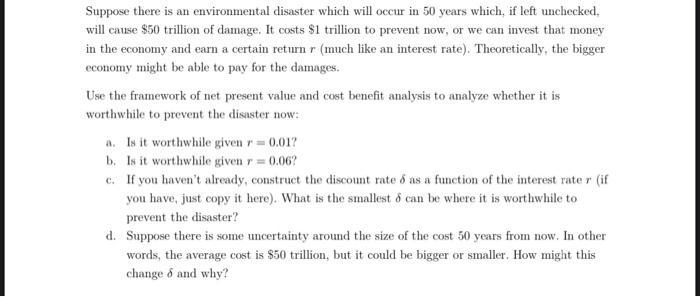

Suppose there is an environmental disaster which will occur in 50 years which, if left unchecked. will cause $50 trillion of damage. It costs $1 trillion to prevent now, or we can invest that money in the economy and earn a certain return r (much like an interest rate). Theoretically, the bigger economy might be able to pay for the damages. Use the framework of net present value and cost benefit analysis to analyze whether it is worthwhile to prevent the disaster now: a. Is it worthwhile given r= 0.017 b. Is it worthwhile given r=0.06? c. If you haven't already, construct the discount rate & as a function of the interest rater (if you have, just copy it here). What is the smallest & can be where it is worthwhile to prevent the disaster? d. Suppose there is some uncertainty around the size of the cost 50 years from now. In other words, the average cost is $50 trillion, but it could be bigger or smaller. How might this change 8 and why?

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Solution If Q be the charge on the capacitor the surface ... View full answer

Get step-by-step solutions from verified subject matter experts