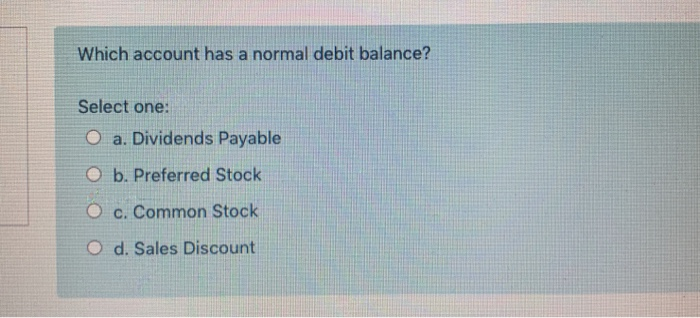

Question: Which account has a normal debit balance? Select one: O a. Dividends Payable b. Preferred Stock O c. Common Stock O d. Sales Discount Hilu

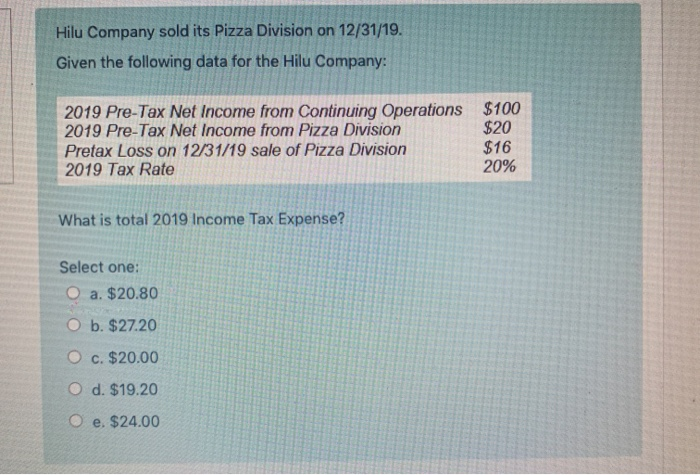

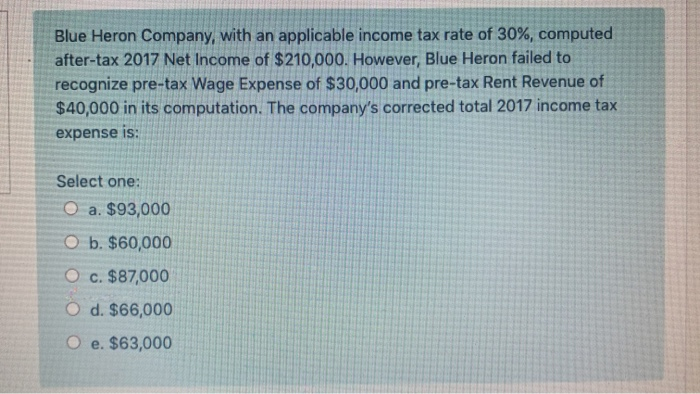

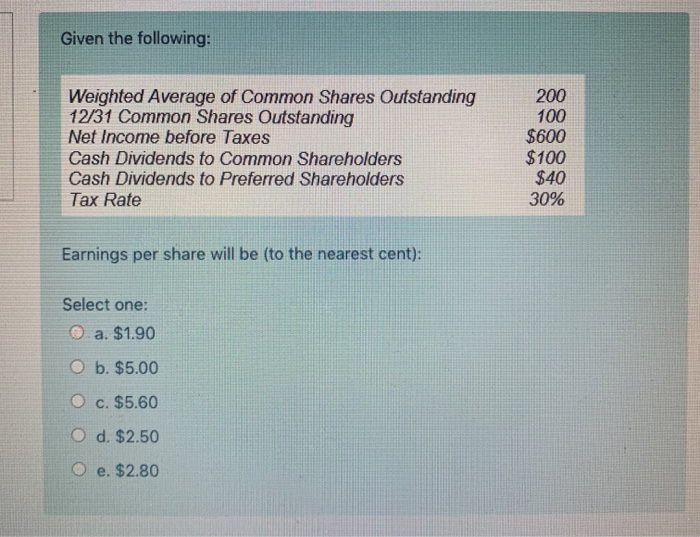

Which account has a normal debit balance? Select one: O a. Dividends Payable b. Preferred Stock O c. Common Stock O d. Sales Discount Hilu Company sold its Pizza Division on 12/31/19. Given the following data for the Hilu Company: 2019 Pre-Tax Net Income from Continuing Operations $100 2019 Pre-Tax Net Income from Pizza Division $20 Pretax Loss on 12/31/19 sale of Pizza Division $16 2019 Tax Rate 20% What is total 2019 Income Tax Expense? Select one: O a. $20.80 O b. $27.20 O c. $20.00 O d. $19.20 O e. $24.00 Blue Heron Company, with an applicable income tax rate of 30%, computed after-tax 2017 Net Income of $210,000. However, Blue Heron failed to recognize pre-tax Wage Expense of $30,000 and pre-tax Rent Revenue of $40,000 in its computation. The company's corrected total 2017 income tax expense is: Select one: O a. $93,000 O b. $60,000 O c. $87,000 O d. $66,000 O e. $63,000 Given the following: Weighted Average of Common Shares Outstanding 12/31 Common Shares Outstanding Net Income before Taxes Cash Dividends to Common Shareholders Cash Dividends to Preferred Shareholders Tax Rate 200 100 $600 $100 $40 30% Earnings per share will be (to the nearest cent): Select one: O a. $1.90 O b. $5.00 O c. $5.60 O d. $2.50 O e. $2.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts