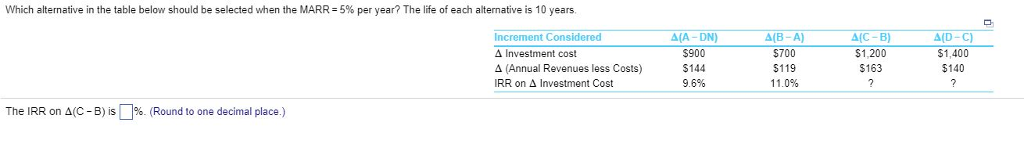

Question: Which alternative in the table below should be selected when the MARR = 5% per year? The life of each alternative is 10 years. can

Which alternative in the table below should be selected when the MARR = 5% per year? The life of each alternative is 10 years. can you help me find the IRR by showing me how to get the answers? thanks

which alternative in the table below should be selected when the MARR-5% per year? The life of each alternative is 10 years Increment Considered Investment cost (Annual Revenues less Costs) IRR on Investment Cost A(A-DN) $900 144 9.6% A(B-A) $700 $119 11.096 A(C-B) $1,200 $163 A(D-C) $1,400 $140 The IRR on (C-B) is L (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts