Question: Which alternative should be selected using incremental rate of return analysis, if MARR = 8.5%? Do-nothing A B C D First cost 0 $6,500 $4,500

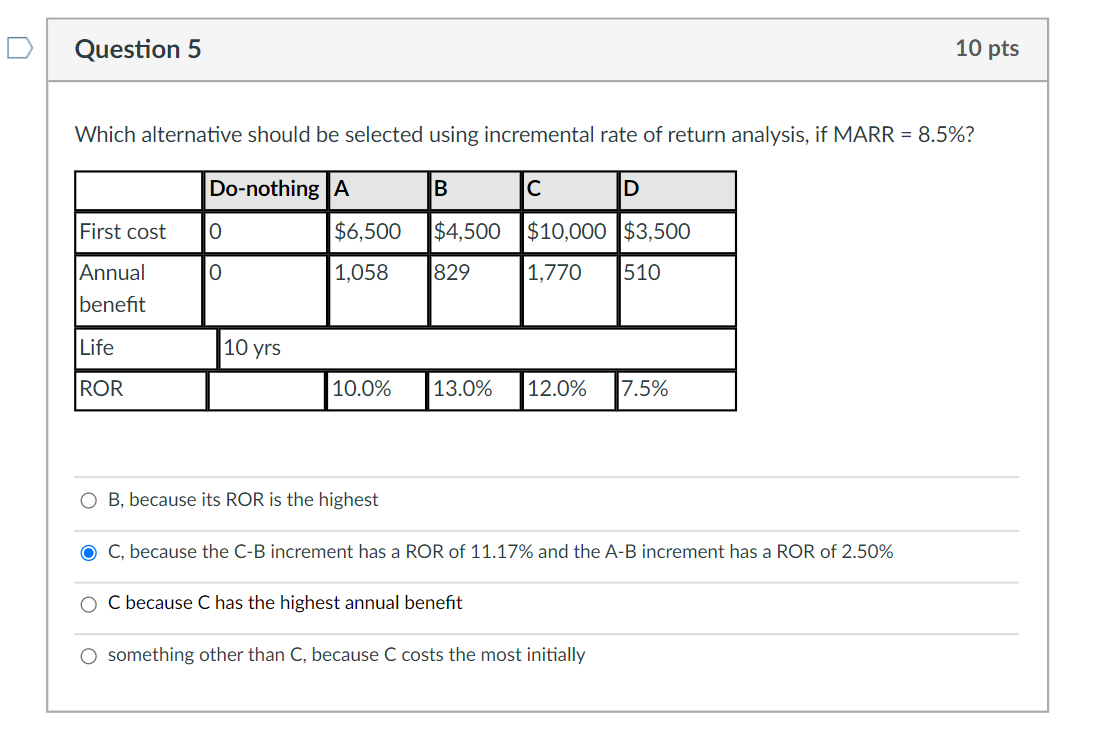

Which alternative should be selected using incremental rate of return analysis, if MARR = 8.5%?

| Do-nothing | A | B | C | D | |

| First cost | 0 | $6,500 | $4,500 | $10,000 | $3,500 |

| Annual benefit | 0 | 1,058 | 829 | 1,770 | 510 |

| Life | 10 yrs |

| ROR | 10.0% | 13.0% | 12.0% | 7.5% |

Group of answer choices

B, because its ROR is the highest

C, because the C-B increment has a ROR of 11.17% and the A-B increment has a ROR of 2.50%

C because C has the highest annual benefit

something other than C, because C costs the most initially

please show steps and formulas

Which alternative should be selected using incremental rate of return analysis, if MARR =8.5%? B, because its ROR is the highest C, because the C-B increment has a ROR of 11.17% and the A-B increment has a ROR of 2.50% C because C has the highest annual benefit something other than C, because C costs the most initially

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts