Question: which answer would it beThe problem was too big to fit in one piture but each picture shows part of the problem vioduie S Exam-Proctored

which answer would it beThe problem was too big to fit in one piture but each picture shows part of the problem

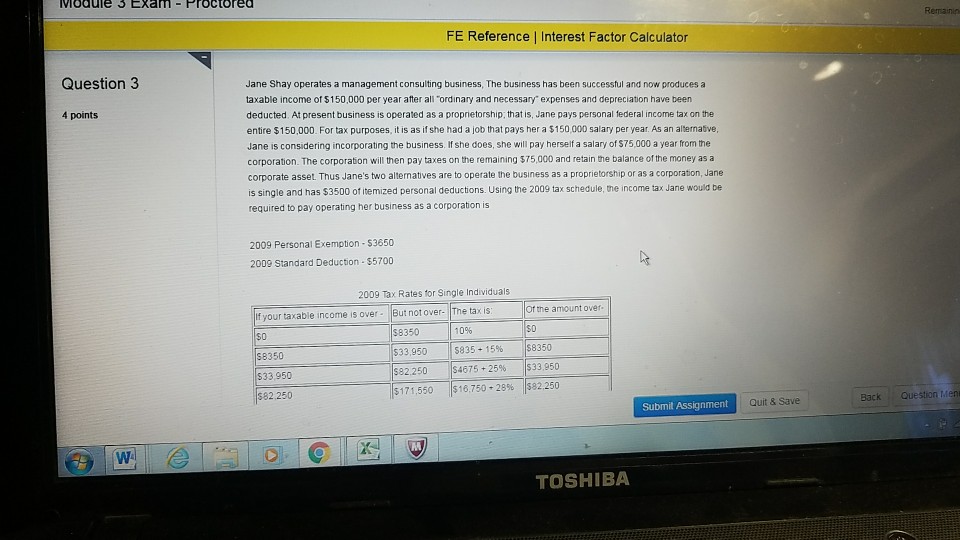

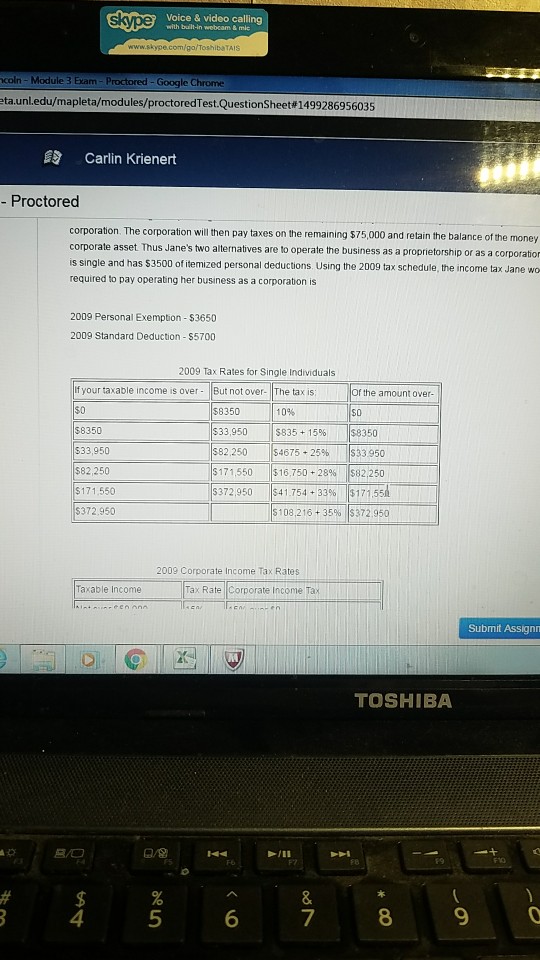

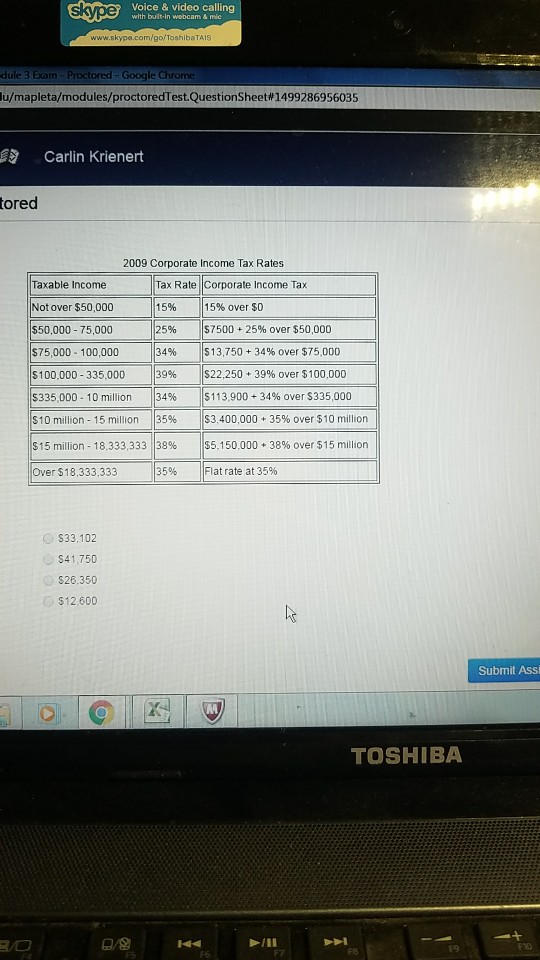

vioduie S Exam-Proctored FE Reference | Interest Factor Calculator Question 3 Jane Shay operates a management consulting business, The business has been successful and now produces a taxable income of $150,000 per year after all "ordinary and necessary' expenses and depreciation have beer deducted. At present business is operated as a proprietorship, that is, Jane pays personal federal income tax on the entire $150,000. For tax purposes, it is as if she had a job that pays her a $150,000 salary per year. As an alternative Jane is considering incorporating the business. If she does, she will pay herself a salary of $75,000 a year from the corporation. The corporaton will then pay taxes on the remaining $75,000 and retain the balance of the money as a corporate asset. Thus Jane's two alternatives are to operate the business as a proprietorship or as a corporation, Jane is single and has $3500 of itemized personal deductions. Using the 2009 tax schedule, the income tax Jane would be required to pay operating her business as a corporation is 4 points 2009 Personal Exemption $3650 2009 Standard Deduction - $5700 2009 Tax Rates tor Single Individuals But not over- The tax is If your taxable income is over Of the amount over S8350 $33,950 $82,250 38350 $33,950S $82.250 | $171.550 ||$16.750 , 28% 10% $835 + 15% S4675 + 25% IS8350 |$33.950 1$82.250 Quit & Save Back Question Meni Submit Assignment TOSHIBA vioduie S Exam-Proctored FE Reference | Interest Factor Calculator Question 3 Jane Shay operates a management consulting business, The business has been successful and now produces a taxable income of $150,000 per year after all "ordinary and necessary' expenses and depreciation have beer deducted. At present business is operated as a proprietorship, that is, Jane pays personal federal income tax on the entire $150,000. For tax purposes, it is as if she had a job that pays her a $150,000 salary per year. As an alternative Jane is considering incorporating the business. If she does, she will pay herself a salary of $75,000 a year from the corporation. The corporaton will then pay taxes on the remaining $75,000 and retain the balance of the money as a corporate asset. Thus Jane's two alternatives are to operate the business as a proprietorship or as a corporation, Jane is single and has $3500 of itemized personal deductions. Using the 2009 tax schedule, the income tax Jane would be required to pay operating her business as a corporation is 4 points 2009 Personal Exemption $3650 2009 Standard Deduction - $5700 2009 Tax Rates tor Single Individuals But not over- The tax is If your taxable income is over Of the amount over S8350 $33,950 $82,250 38350 $33,950S $82.250 | $171.550 ||$16.750 , 28% 10% $835 + 15% S4675 + 25% IS8350 |$33.950 1$82.250 Quit & Save Back Question Meni Submit Assignment TOSHIBA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts