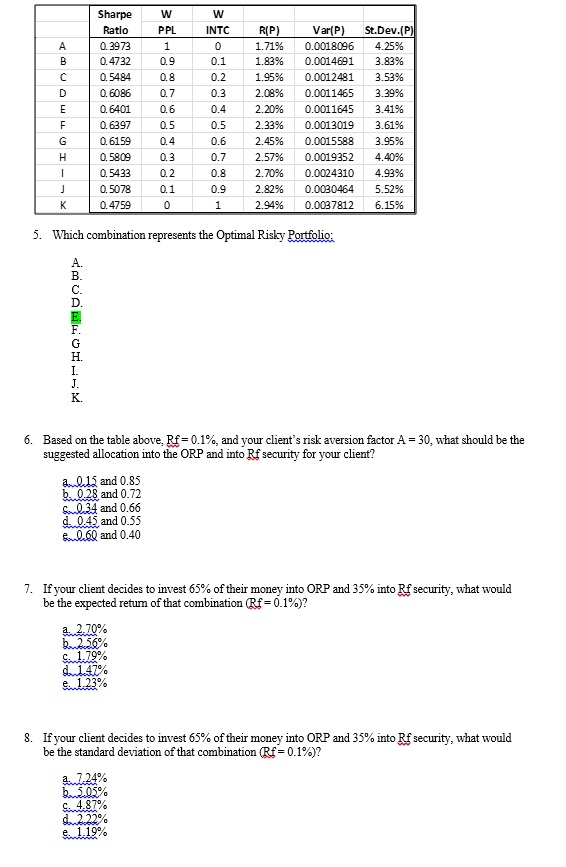

Question: Which combination represents the Optimal Risky Portfolio; Based on the table above. Rf= 0.1%, and your client's risk aversion factor A = 30, what should

Which combination represents the Optimal Risky Portfolio; Based on the table above. Rf= 0.1%, and your client's risk aversion factor A = 30, what should be the suggested allocation into the ORP and into Rf security for your client? 0.15 and 0.85 0.28 and 0.72 0.34 and 0.66 0.45 and 0.55 0.60 and 0.40 If your client decides to invest 65% of their money into ORP and 35% into Rf security, what would be the expected return of that combination (Rf = 0.1%)? 2.70% 1.79% 1.47% 1.23% If your client decides to invest 65% of their money into ORP and 35% into Rf security, what would be the standard deviation of that combination (Rf = 0.1%)? 7.24% 4.87% 2.22% 1.19%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts