Question: Which every client has more risk adverse? what does it tell you about their portfolio perfences? frame your answer in terms of mean and variance

Which every client has more risk adverse? what does it tell you about their portfolio perfences? frame your answer in terms of mean and variance

Which every client has more risk adverse? what does it tell you about their portfolio perfences? frame your answer in terms of mean and variance

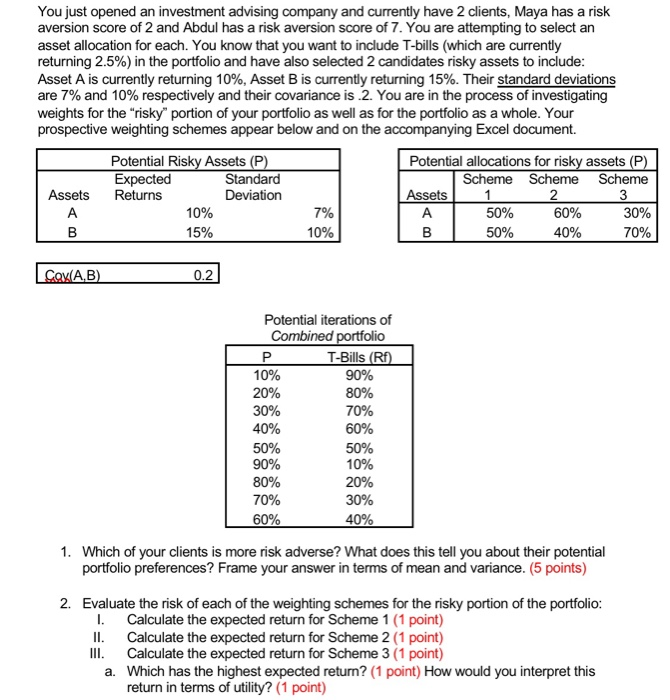

You just opened an investment advising company and currently have 2 clients, Maya has a risk aversion score of 2 and Abdul has a risk aversion score of 7. You are attempting to select an asset allocation for each. You know that you want to include T-bills (which are currently returning 2.5%) in the portfolio and have also selected 2 candidates risky assets to include: Asset A is currently returning 10%, Asset B is currently returning 15%. Their standard deviations are 7% and 10% respectively and their covariance is 2. You are in the process of investigating weights for the "risky" portion of your portfolio as well as for the portfolio as a whole. Your prospective weighting schemes appear below and on the accompanying Excel document. Assets Potential Risky Assets (P) Expected Standard Returns Deviation 10% 15% Potential allocations for risky assets (P) Scheme Scheme Scheme Assets 12 50% 60% 30% 50% 40% 70% 7% B 10% Cox(A,B) 0.2 20% Potential iterations of Combined portfolio T-Bills (R1) 10% 90% 80% 30% 70% 40% 50% 50% 90% 10% 20% 30% 60% 40% 60% 80% 70% 1. Which of your clients is more risk adverse? What does this tell you about their potential portfolio preferences? Frame your answer in terms of mean and variance. (5 points) 2. Evaluate the risk of each of the weighting schemes for the risky portion of the portfolio: I. Calculate the expected return for Scheme 1 (1 point) II. Calculate the expected return for Scheme 2 (1 point) III. Calculate the expected return for Scheme 3 (1 point) a. Which has the highest expected return? (1 point) How would you interpret this return in terms of utility? (1 point) EEEEEEEEE You just opened an investment advising company and currently have 2 clients, Maya has a risk aversion score of 2 and Abdul has a risk aversion score of 7. You are attempting to select an asset allocation for each. You know that you want to include T-bills (which are currently returning 2.5%) in the portfolio and have also selected 2 candidates risky assets to include: Asset A is currently returning 10%, Asset B is currently returning 15%. Their standard deviations are 7% and 10% respectively and their covariance is 2. You are in the process of investigating weights for the "risky" portion of your portfolio as well as for the portfolio as a whole. Your prospective weighting schemes appear below and on the accompanying Excel document. Assets Potential Risky Assets (P) Expected Standard Returns Deviation 10% 15% Potential allocations for risky assets (P) Scheme Scheme Scheme Assets 12 50% 60% 30% 50% 40% 70% 7% B 10% Cox(A,B) 0.2 20% Potential iterations of Combined portfolio T-Bills (R1) 10% 90% 80% 30% 70% 40% 50% 50% 90% 10% 20% 30% 60% 40% 60% 80% 70% 1. Which of your clients is more risk adverse? What does this tell you about their potential portfolio preferences? Frame your answer in terms of mean and variance. (5 points) 2. Evaluate the risk of each of the weighting schemes for the risky portion of the portfolio: I. Calculate the expected return for Scheme 1 (1 point) II. Calculate the expected return for Scheme 2 (1 point) III. Calculate the expected return for Scheme 3 (1 point) a. Which has the highest expected return? (1 point) How would you interpret this return in terms of utility? (1 point) EEEEEEEEE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts