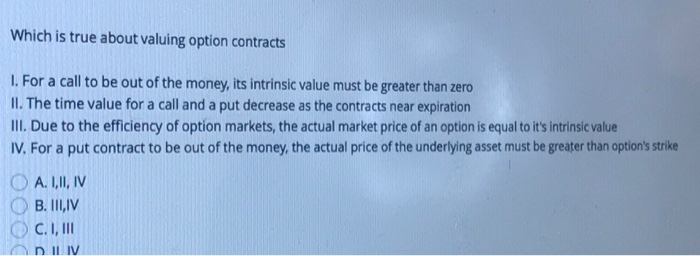

Question: Which is true about valuing option contracts For a call to be out of the money, its intrinsic value must be greater than zero The

Which is true about valuing option contracts For a call to be out of the money, its intrinsic value must be greater than zero The time value for a call and a put decrease as the contracts near expiration Due to the efficiency of option markets, the actual market price of an option is equal to it's intrinsic value For a put contract to be out of the money, the actual price of the underlying asset must be greater than option's strike I, II, IV III, IV I, III II IV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts