Question: which items above match these definitions? Hatching Business Transaction Source Document Objectivity Concept Business Entity Assumption Monetary Unit Assumption Expense Recognition/Matching Principle Historical Cost Principle

which items above match these definitions?

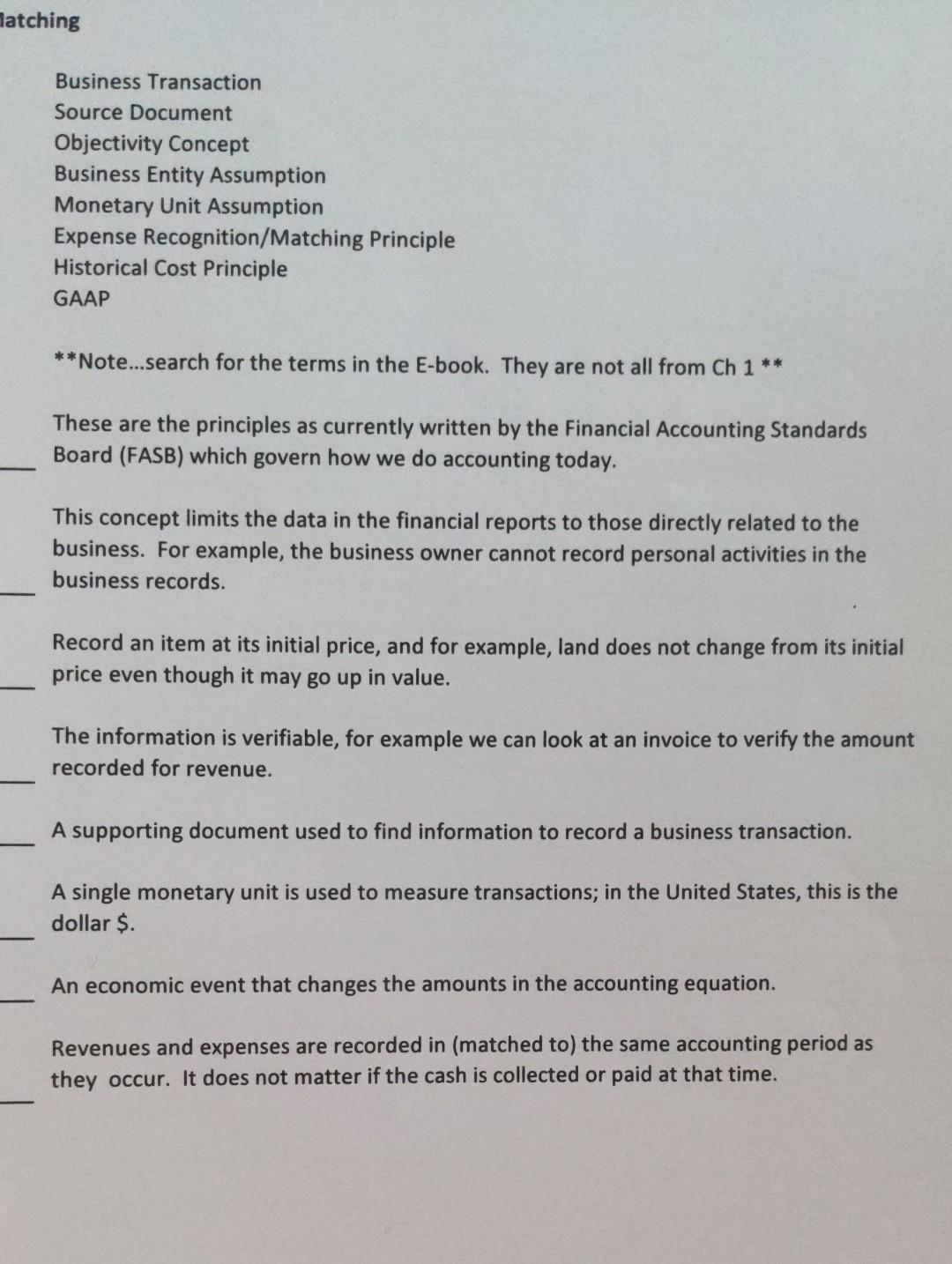

Hatching Business Transaction Source Document Objectivity Concept Business Entity Assumption Monetary Unit Assumption Expense Recognition/Matching Principle Historical Cost Principle GAAP **Note...search for the terms in the E-book. They are not all from Ch 1 These are the principles as currently written by the Financial Accounting Standards Board (FASB) which govern how we do accounting today. This concept limits the data in the financial reports to those directly related to the business. For example, the business owner cannot record personal activities in the business records. Record an item at its initial price, and for example, land does not change from its initial price even though it may go up in value. The information is verifiable, for example we can look at an invoice to verify the amount recorded for revenue. A supporting document used to find information to record a business transaction. A single monetary unit is used to measure transactions; in the United States, this is the dollar $. An economic event that changes the amounts in the accounting equation. Revenues and expenses are recorded in (matched to) the same accounting period as they occur. It does not matter if the cash is collected or paid at that time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts