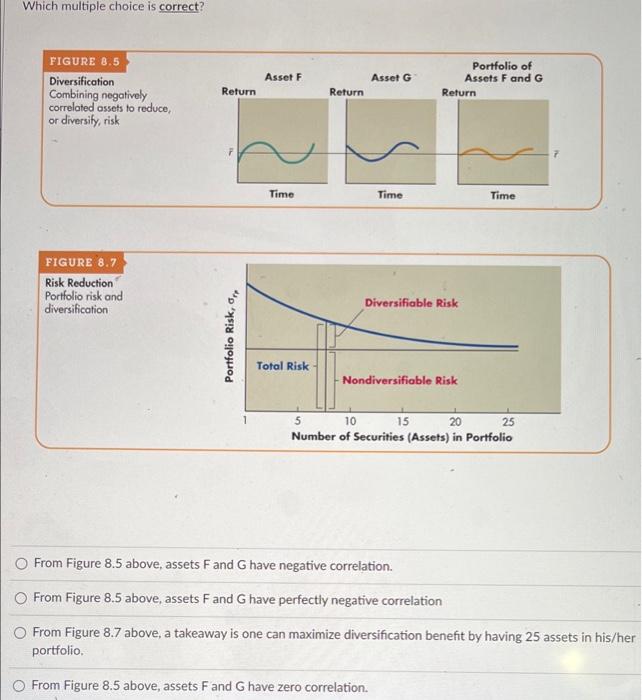

Question: Which multiple choice is correct? Asset F FIGURE 8.5 Diversification Combining negatively correlated assets to reduce or diversity, risk Asset G Return Portfolio of Assets

Which multiple choice is correct? Asset F FIGURE 8.5 Diversification Combining negatively correlated assets to reduce or diversity, risk Asset G Return Portfolio of Assets F and G Return Return Time Time Time FIGURE 8.7 Risk Reduction Portfolio risk and diversification Diversifiable Risk Portfolio Risk, og Total Risk Nondiversifiable Risk 1 5 10 15 20 25 Number of Securities (Assets) in Portfolio From Figure 8.5 above, assets F and G have negative correlation From Figure 8.5 above, assets F and G have perfectly negative correlation From Figure 8.7 above, a takeaway is one can maximize diversification benefit by having 25 assets in his/her portfolio. From Figure 8.5 above, assets F and G have zero correlation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts