Question: Which of the following events is likely to decrease the value of call options on the common stock of GCC Company? a. An increase in

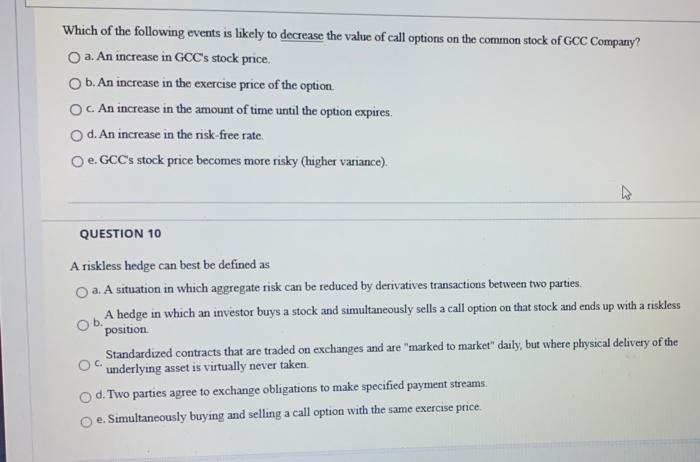

Which of the following events is likely to decrease the value of call options on the common stock of GCC Company? a. An increase in GCC's stock price. b. An increase in the exercise price of the option Oc An increase in the amount of time until the option expires. d. An increase in the risk-free rate. e. GCC's stock price becomes more risky (higher variance) QUESTION 10 Ob. A riskless hedge can best be defined as a. A situation in which aggregate risk can be reduced by derivatives transactions between two parties, A hedge in which an investor buys a stock and simultaneously sells a call option on that stock and ends up with a riskless position Standardized contracts that are traded on exchanges and are "marked to market" daily, but where physical delivery of the underlying asset is virtually never taken. d. Two parties agree to exchange obligations to make specified payment streams e. Simultaneously buying and selling a call option with the same exercise price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts