Question: Which of the following problems can be solved using the future value of annuity tool introduced in this class? a O a Sherry has taken

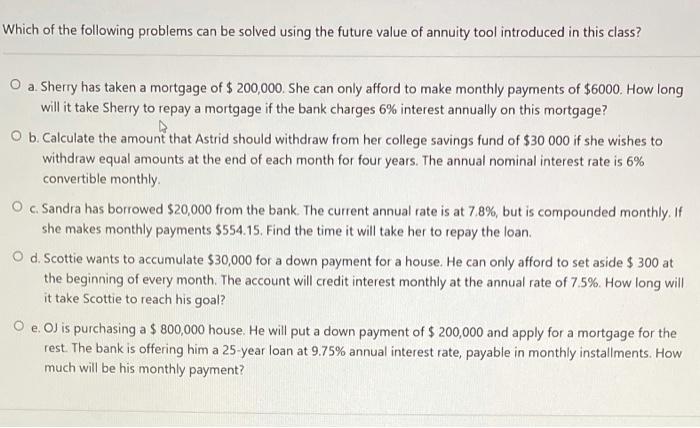

Which of the following problems can be solved using the future value of annuity tool introduced in this class? a O a Sherry has taken a mortgage of $ 200,000. She can only afford to make monthly payments of $6000. How long will it take Sherry to repay a mortgage if the bank charges 6% interest annually on this mortgage? O b. Calculate the amount that Astrid should withdraw from her college savings fund of $30 000 if she wishes to withdraw equal amounts at the end of each month for four years. The annual nominal interest rate is 6% convertible monthly O c. Sandra has borrowed $20,000 from the bank. The current annual rate is at 78%, but is compounded monthly. If she makes monthly payments $554.15. Find the time it will take her to repay the loan. O d. Scottie wants to accumulate $30,000 for a down payment for a house. He can only afford to set aside $ 300 at the beginning of every month. The account will credit interest monthly at the annual rate of 7.5%. How long will it take Scottie to reach his goal? O e OJ is purchasing a $ 800,000 house. He will put a down payment of $ 200,000 and apply for a mortgage for the rest. The bank is offering him a 25-year loan at 9.75% annual interest rate, payable in monthly installments. How much will be his monthly payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts