Question: Which of the following statement is incorrect about return gap or investor gap? The return gap is usually bigger in up years comparing to down

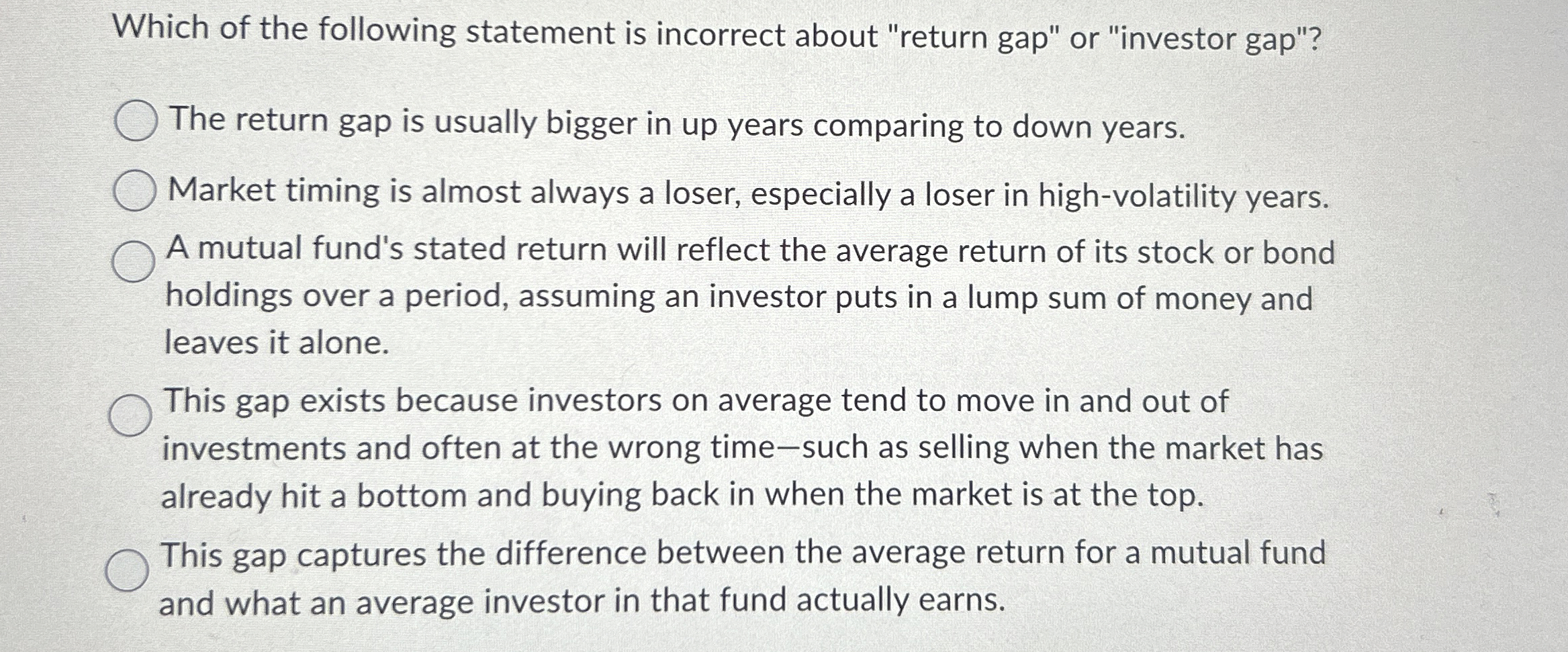

Which of the following statement is incorrect about "return gap" or "investor gap"?

The return gap is usually bigger in up years comparing to down years.

Market timing is almost always a loser, especially a loser in highvolatility years.

A mutual fund's stated return will reflect the average return of its stock or bond

holdings over a period, assuming an investor puts in a lump sum of money and

leaves it alone.

This gap exists because investors on average tend to move in and out of

investments and often at the wrong timesuch as selling when the market has

already hit a bottom and buying back in when the market is at the top.

This gap captures the difference between the average return for a mutual fund

and what an average investor in that fund actually earns.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock