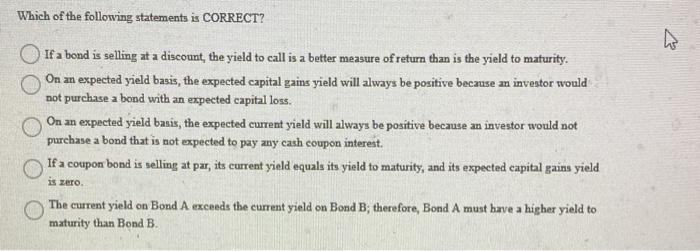

Question: Which of the following statements is CORRECT? If a bond is selling at a discount, the yield to call is a better measure of return

Which of the following statements is CORRECT? If a bond is selling at a discount, the yield to call is a better measure of return than is the yield to maturity. On an expected yield basis, the expected capital gains yield will always be positive because an investor would not purchase a bond with an expected capital loss. On an expected yield basis, the expected current yield will always be positive because an investor would not purchase a bond that is not expected to pay any cash coupon interest. If a coupon bond is selling at par, its current yield equals its yield to maturity, and its expected capital gains yield is zero . The current yield on Bond A exceeds the current yield on Bond B; therefore, Bond A must have a higher yield to maturity than Bond B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts