Question: Which of the following would decrease the financial leverage of a firm? Total assets increase and the debt-to-equity ratio remains constant New equity is sold

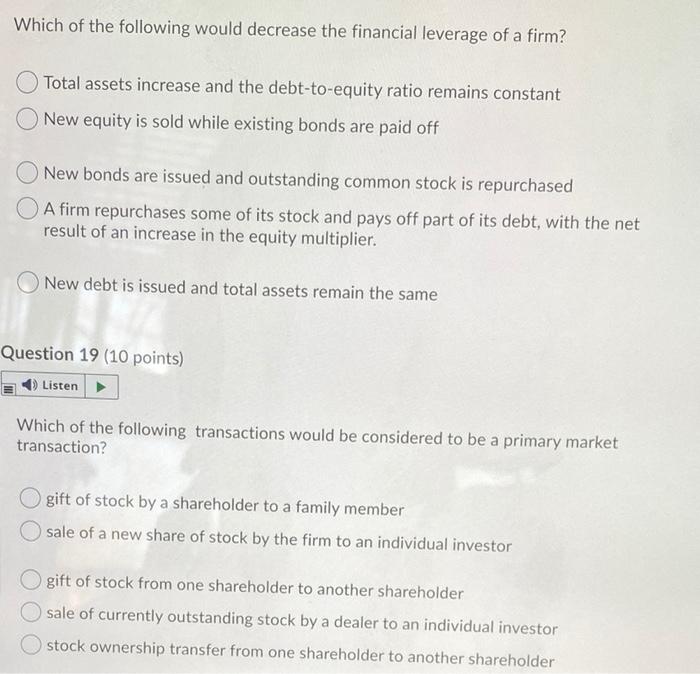

Which of the following would decrease the financial leverage of a firm? Total assets increase and the debt-to-equity ratio remains constant New equity is sold while existing bonds are paid off New bonds are issued and outstanding common stock is repurchased A firm repurchases some of its stock and pays off part of its debt, with the net result of an increase in the equity multiplier. New debt is issued and total assets remain the same Question 19 (10 points) Listen Which of the following transactions would be considered to be a primary market transaction? gift of stock by a shareholder to a family member sale of a new share of stock by the firm to an individual investor gift of stock from one shareholder to another shareholder sale of currently outstanding stock by a dealer to an individual investor stock ownership transfer from one shareholder to another shareholder

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts