Question: Which of the statements below is incorrect regarding the difference between Strategic Asset Allocation *SAA) and Tactical Asset Allocation (TAA)? An SAA without TAA may

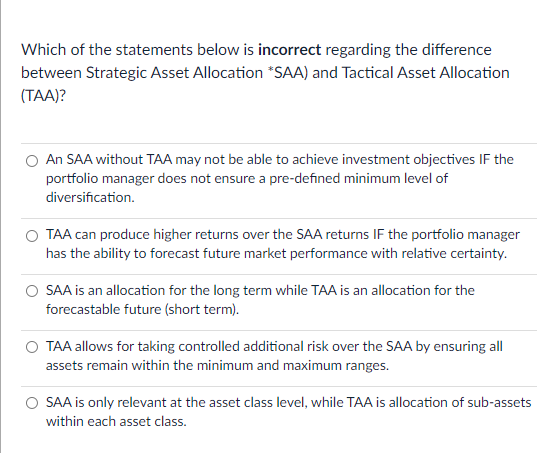

Which of the statements below is incorrect regarding the difference between Strategic Asset Allocation *SAA) and Tactical Asset Allocation (TAA)? An SAA without TAA may not be able to achieve investment objectives IF the portfolio manager does not ensure a pre-defined minimum level of diversification. TAA can produce higher returns over the SAA returns IF the portfolio manager has the ability to forecast future market performance with relative certainty. SAA is an allocation for the long term while TAA is an allocation for the forecastable future (short term). TAA allows for taking controlled additional risk over the SAA by ensuring all assets remain within the minimum and maximum ranges. SAA is only relevant at the asset class level, while TAA is allocation of sub-assets within each asset class

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts