Question: Which one of the following examples is a correct application of the Pure Play approach to estimate divisional WAC? Sallys Salons owns a makeup subsidiary,

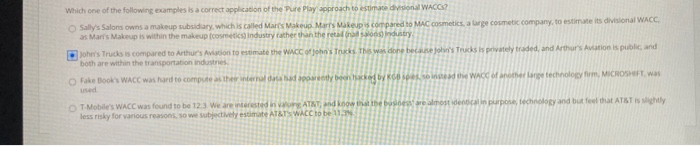

Which one of the following examples is a correct application of the Pure Play approach to estimate divisional WAC? Sallys Salons owns a makeup subsidiary, which is called Mart's Makeup Marts Makeup is compared to MAC Cosmetics, a large cosmetic company, to estimate its divisional WACC. as Marrs Makeup is within the makeup cosmetics industry rather than the reasons industry John's Trucks is compared to Arthur's Aviation to estimate the WACC hos Tracks. This was done because John's Trucks is privately traded, and Arthur's Aviation is public and both are within the transportation industries Fake Books WACC was hard to compute as the internal da dapat beby Bed the WACC of another lange technology form, MICROSOFT was T-Mobile's WACC was found to be 12.3. We are interested in TRT and know that the business are almost declin purpose, technology and but feel that ATST is slightly less risky for various reasons, so we subjectively estimate AT&TS WACC to be 113

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts