Question: Which one of the following will decrease the net present value of a project? A. increasing the value of each of the project's discounted cash

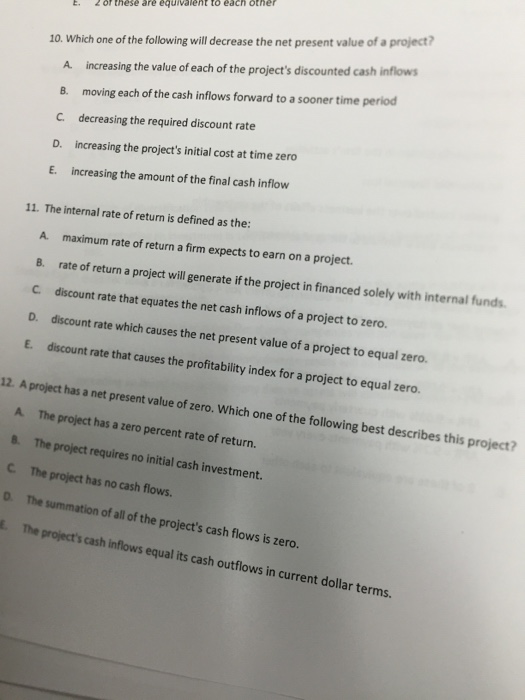

Which one of the following will decrease the net present value of a project? A. increasing the value of each of the project's discounted cash inflows B. moving each of the cash inflows forward to a sooner lime periodC. decreasing the required discount rate D. increasing the project's initial cost at time zero E. increasing the amount of the final cash inflow The internal rate of return is defined as the: A. maximum rate of return a firm expects to earn on a project. B. rate of return a project will generate if the project in financed solely with internal funds. C. discount rate that equates the net cash Inflows of a project to zero. D. discount rate which causes the net present value of a project to equal zero. E. discount rate that cause the profitability index for a project to equal zero. A project has a present value of zero. Which one of the following best describes this project? A. The project has a zero percent rate of return. B. The project requires no ini

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts