Question: Which portfolio performance measure would be most applicable to each of the following situations? a) A large university endowment fund wants to evaluate the performance

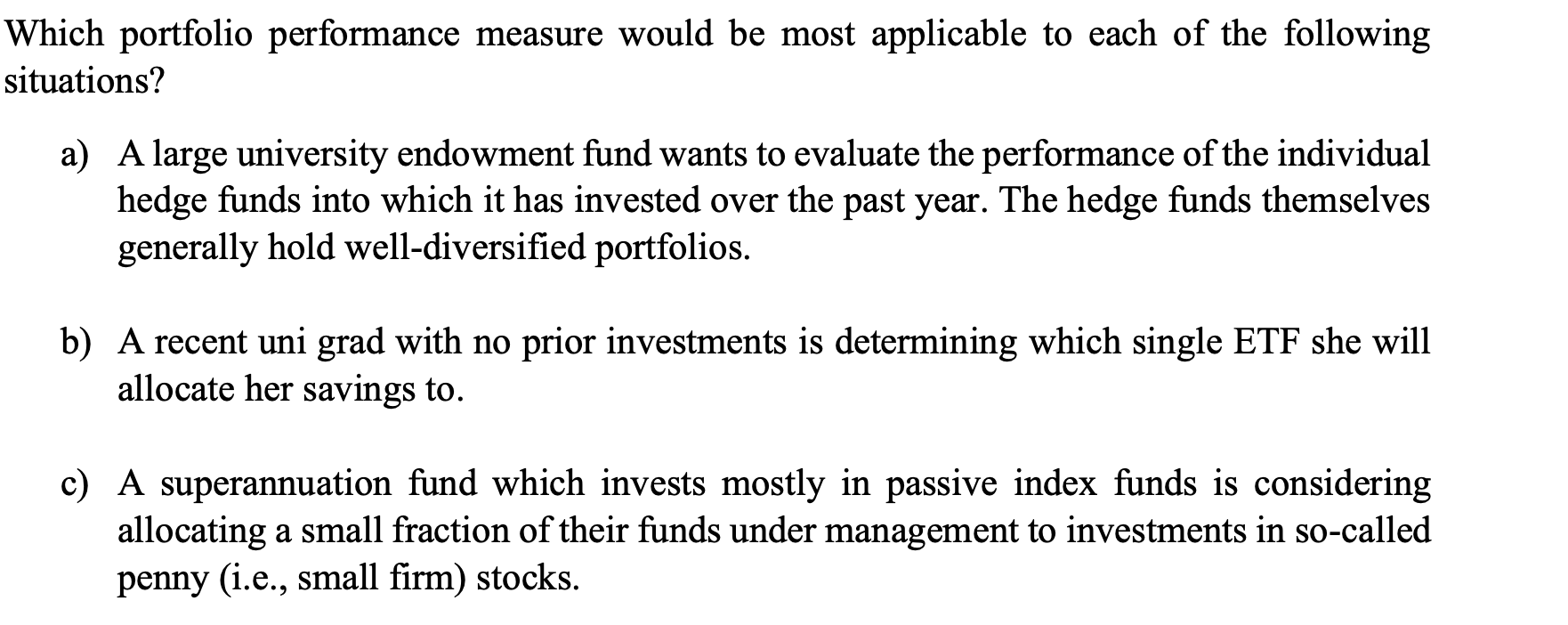

Which portfolio performance measure would be most applicable to each of the following situations? a) A large university endowment fund wants to evaluate the performance of the individual hedge funds into which it has invested over the past year. The hedge funds themselves generally hold well-diversified portfolios. b) A recent uni grad with no prior investments is determining which single ETF she will allocate her savings to. c) A superannuation fund which invests mostly in passive index funds is considering allocating a small fraction of their funds under management to investments in so-called penny (i.e., small firm) stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts