Question: Which statement about kiddie tax is false? In certain circumstances a child with very little income may have at least a portion of their income

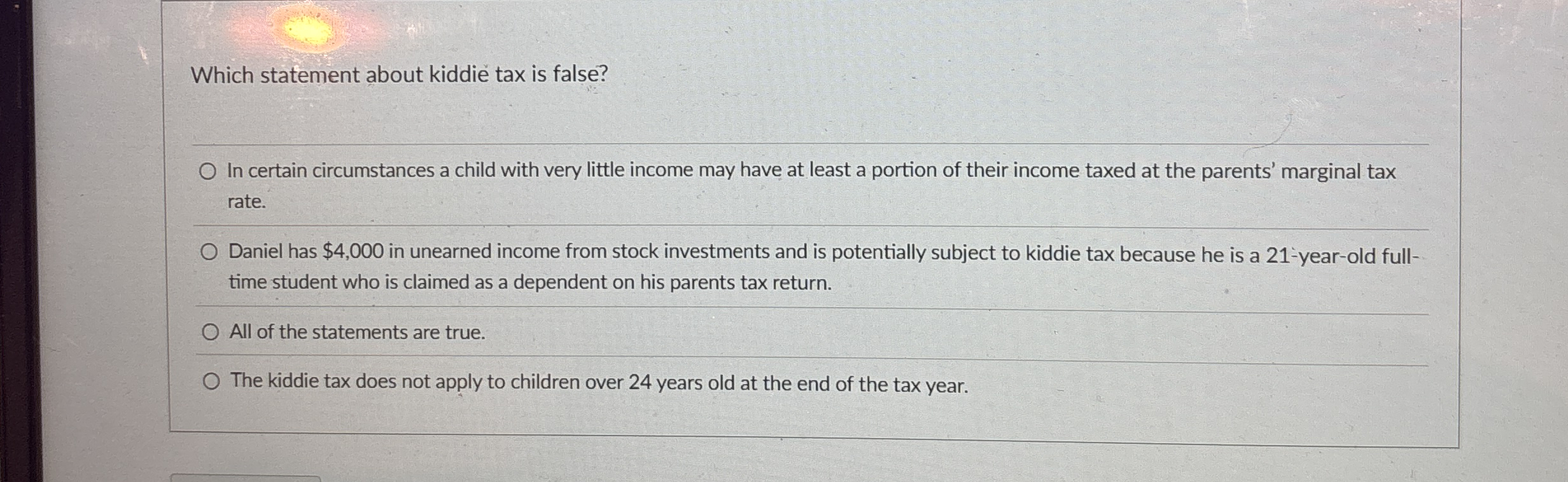

Which statement about kiddie tax is false?

In certain circumstances a child with very little income may have at least a portion of their income taxed at the parents' marginal tax rate.

Daniel has $ in unearned income from stock investments and is potentially subject to kiddie tax because he is a yearold fulltime student who is claimed as a dependent on his parents tax return.

All of the statements are true.

The kiddie tax does not apply to children over years old at the end of the tax year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock